When helping business owners sell their businesses, we usually start with two key steps:

- Determine what the business is worth i.e. conduct an independent valuation or market appraisal;

- Determine how the business would appear to a potential buyer.

Step 2 is what we term ‘vendor due diligence’ and it basically involves us looking at the business from a buyer’s point of view.

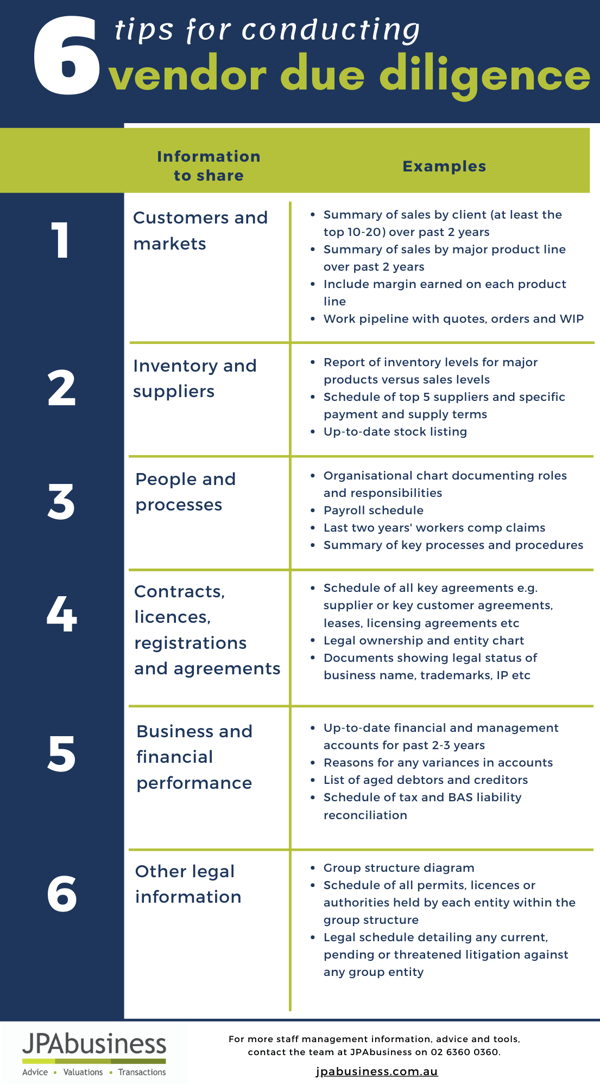

The following infographic outlines some of the key information we would need the seller to provide, in order for us – as a ‘buyer’ – to confidently assess the potential risks and returns of their business opportunity.

Do I need to do vendor due diligence?

Following the steps in the infographic and ensuring the information listed there is gathered, collated and clearly presented, means that when a potential purchaser ‘opens the bonnet’ on your business, they’re able to easily see how it is performing.

Not gathering this information before buyers come knocking can really dent their confidence in your business opportunity and hurt your chances of maximising value on exit.

Free resources

For a more detailed examination of the vendor due diligence process, download these free resources:

- ebook – How to prepare your business for sale

- template – Vendor Due Diligence Checklist

JPAbusiness offers a wide range of services for business buyers and sellers. If you are considering buying or selling a business, contact the business advisory team on 02 6360 0360 or 02 9893 1803 for a confidential, initial discussion.