Being able to prove repeatability of earnings – with robust data and a reasonable level of confidence – is key to maximising business value on exit.

As a business valuer I often need to have difficult conversations with clients who assume their business value will be based purely on past performance.

They look longingly at past results and say: “Based on those fantastic results I think my business should be worth X. Why are you saying it’s only worth Y?”

My response is: “I’m sorry, but someone coming into the business will not see the benefit of those past earnings. You’ve had the benefit of those. A buyer is most interested in the extent to which those reported earnings can be repeated in the future.”

How to prove repeatability of earnings

To determine the sustainability of a business’s earnings beyond its current ownership, we turn to the concept of future maintainable earnings (FME – also known as sustainable earnings, or business maintainable earnings).

You can take a look at some of our past blog posts for a detailed explanation of what determines FME.

Key to proving FME to potential purchasers (or valuers!) is diligent recordkeeping on your:

- work in progress (WIP)

- pipeline

- contracts

- client portfolio.

It’s also important to have a keen understanding of external and local market trends and happenings that may impact you, your clients and suppliers into the future, and be able to clearly communicate those to external parties.

In our free ebook How to give your business a strong forward outlook we examine the key factors discussed above and provide links to three free templates we’ve created to help you keep track of your forward outlook, and assess its contribution to your business’s value:

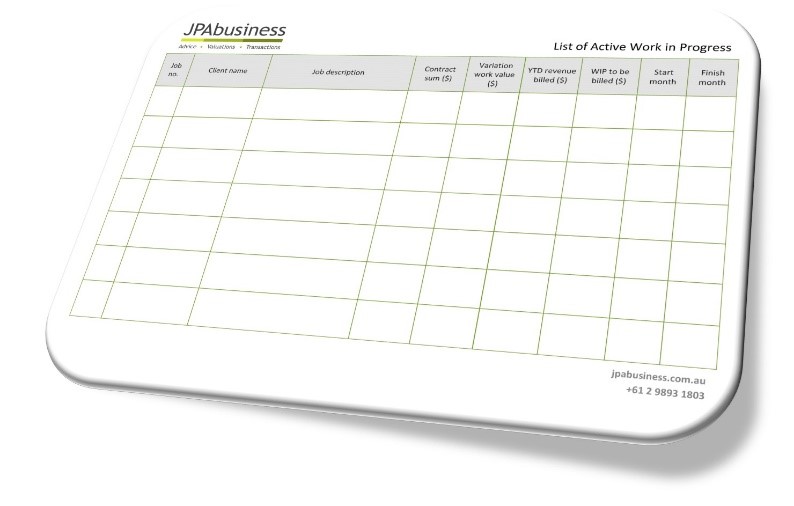

Work-in-progress

These are projects or jobs you have won, which are partially completed and may also be partially invoiced.

These orders might be in the form of a contracted project, or they might be products and services to be supplied. There may have been a part payment from the client, or a purchase order document may have been issued.

The upshot, though, is that there is a legal, contractual arrangement that something needs to be supplied, so there is a level of certainty around those upcoming sales.

The extent to which you have forward orders in the form of WIP is a good indication of the forward run-rate of the business.

Here’s an example:

Construction Business X has averaged EBITDA of $3.75 million per annum over the past three years.

Business X has won a $20 million project to build a block of apartments. 50% of the physical work has been completed and 70% has been invoiced.

(Note to potential buyers: if you are acquiring a business with a WIP situation like this – 50% per cent of work still to be done, but only 30% of income to collect – make sure the people doing your due diligence uncover it. Often in a sale process we will negotiate an adjustment to a purchase price at completion, where these things don’t line up. Unless your advisor has uncovered it, you won’t know until it’s too late.)

WIP also includes confirmed forward orders – the money is not guaranteed, but there is a high likelihood it will end up in the business owner’s bank account.

Of course, different types of businesses will have different profiles of WIP. For example, transactional retail businesses don’t have much WIP, while project-based businesses like construction, or manufacturing businesses with longer-term orders, will have WIP in place.

Use our template to record your list of active WIP, and get used to tracking it on a regular basis.

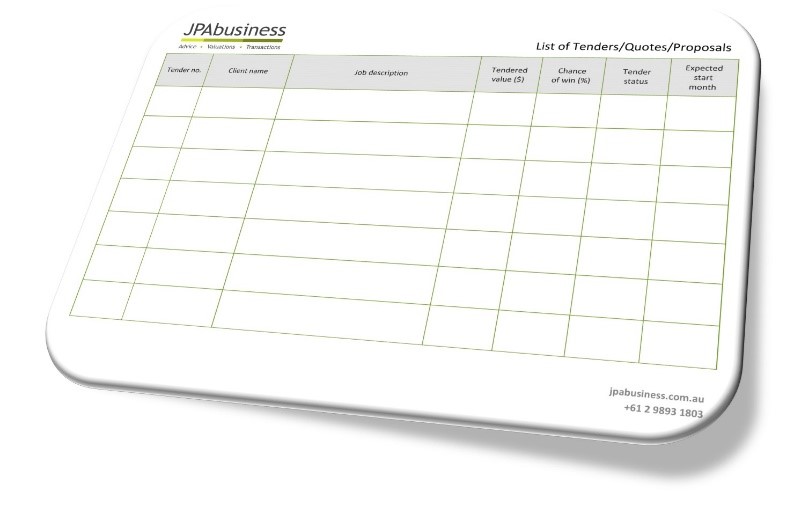

Pipeline

The pipeline is indicative of future sales that the business may benefit from, but they’re not formal confirmed orders.

It includes the projects and jobs you have submitted tenders or quotes/proposals for, but which have not yet been awarded, the value of those tenders, and the likelihood you will win them.

For example:

Business X has tendered for 15 projects with a total value of $120 million and which are due to be awarded over the next three months.

Based on Business X’s past form, which the managers have diligently recorded, the possibility of success (the ‘win rate’) for those projects is 20% (i.e. two project wins per 10 projects tendered).

20% of $120 million is $24 million.

So, the likelihood is Business X will win $24 million worth of tendered projects in the next three months (i.e. this level of business is likely to flow through to the business’s WIP over an extended period beyond this time).

So you can see the pipeline element has more risk attached than WIP, but it is still part of the run-rate for the business.

Use our template to regularly record the tenders, quotes and other proposals in your pipeline.

What’s your win rate?

When valuing a business, we’ll invariably ask a business owner: “What’s your win rate on tenders?”

Often, they’ll look at us vaguely and say: “I don’t know – we only care about the tenders we win.”

It’s critical to document all tenders – successful and unsuccessful – to enable you to prove your win rate to potential purchasers doing due diligence.

No one likes uncertainty when buying a business; providing this data will remove guesswork on their behalf. It will also help you improve management practice by identifying areas for estimating and tendering improvement that may help increase your win rate over time.

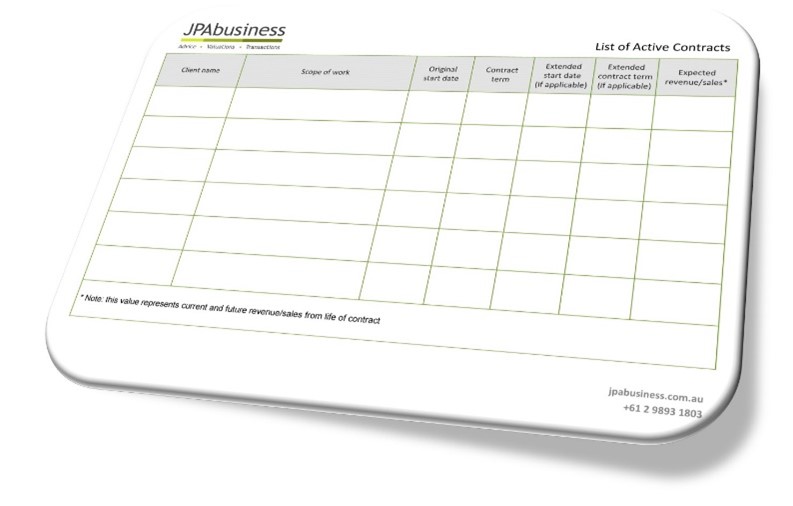

Contracts

The next contributor to forward outlook is contracts, which can fall under both WIP and pipeline.

Some businesses have the benefit of written legal contracts with clients which are based on a fixed or hourly price, and which can provide the business with a level of certainty about the amount and timing of revenue for a set period.

Here’s an example:

A building services firm has a contract to provide maintenance services to three universities over the next 12 months.

The contract includes a minimum scope of works that adds up to $500,000 for 12 months, in terms of sales.

The contract also includes an agreement to provide additional services by way of variation, depending on what the three universities require as part of their public works programs.

So the minimum $500,000 would form part of the firm’s WIP, while there could be another $500,000 that has some risk attached and it effectively forms part of the firm’s pipeline, because it may or may not happen.

If you are a business with contracts, it’s important to have them fully documented and be clear about what they add to your forward sales and earnings. Use our template to record your active contracts.

If you’re looking to build forward earnings and business value, we’re keen to help you. Feel free to get in touch by calling 02 6360 0360 or 02 9893 1803, or visit jpabusiness.com.au to arrange to speak with one of our advisors.