When determining what a small to mid-sized business is worth, Business Maintainable Earnings (BME) is one of the key concepts the market will consider.

BME reflects the ability of a business to generate earnings into the future.

Remember, as a buyer you don’t want to pay for opportunity you will create in the future; unless there is a strategic element to the purchase, ideally you only want to pay for what has been built up by the vendor.

Doing the numbers

Our infographic, How to calculate Business Maintainable Earnings, sets out the calculation we use to determine BME when conducting business valuations and market appraisals on behalf of clients. It shows how to take account of abnormal fluctuations in a business’ performance (i.e. normalise) and calculate the business’ BME.

The calculation is often done on the previous three years’ performance and then looking forward – to at least the next 12 months. The results are also often weighted based on seasonality and other market and business-related factors.

The calculation involves analysis over a number of years because BME represents future maintainable earnings, and therefore the analysis needs to consider business health factors, risks and other issues that impact the business.

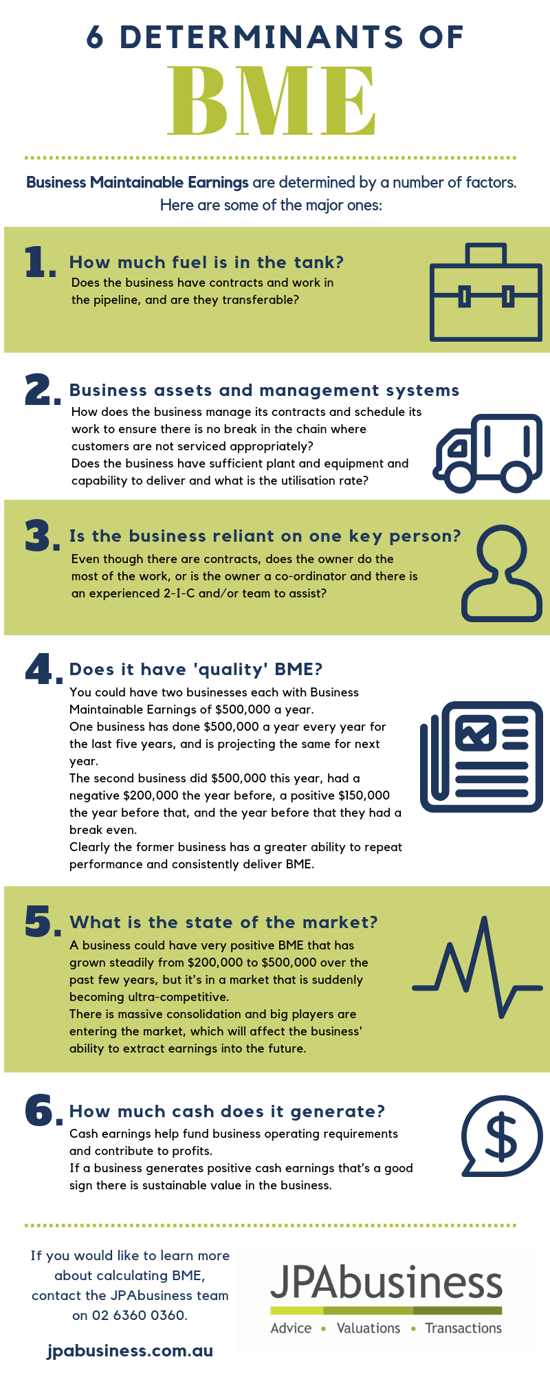

What determines BME?

So, what are these ‘health factors, risks and other issues’ we need consider?

The infographic below sets out some of the major ones.

If you would like assistance to determine BME for a business purchase opportunity you are assessing, contact the team at JPAbusiness for a confidential, obligation-free discussion.