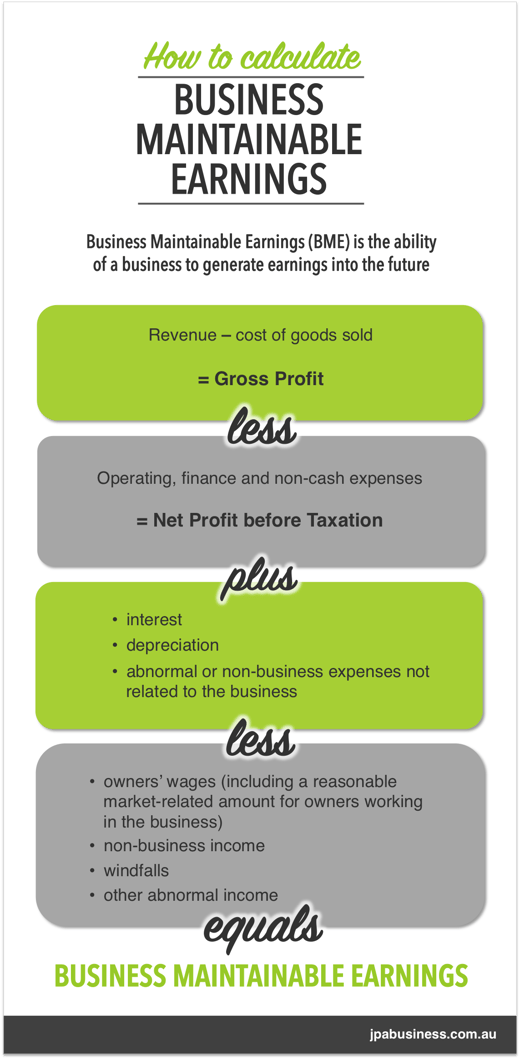

Business Maintainable Earnings (BME) reflect the ability of a business to generate earnings into the future.

BME is the one of the most important concepts the market will consider when assessing a business’ value.

The following infographic shows how to take account of abnormal fluctuations in your business’ performance (i.e. normalise) and calculate your business’ BME.

This calculation is often done on the previous three years’ performance and then looking forward – to at least the next 12 months. The results are also often weighted based on seasonality and other market and business-related factors.

The calculation involves analysis over a number of years because BME represents future maintainable earnings, and therefore the analysis needs to consider business health factors, risks and other issues that impact the business.

As business owners looking to drive value in a business, the stronger and more consistently you can build the picture of BME and show that it is robust, the better your chances of driving greater value when looking to sell, all other things being equal.

If would like assistance to determine your BME or assess business value – whether you are buying, selling or looking to grow the value of your business – contact the team at JPAbusiness for a confidential, obligation-free discussion.