When business owners come to see us, wanting to sell their business, we often get involved in providing ‘vendor due diligence’.

This basically involves us 'pretending' we're a buyer and has two main components:

1. Understanding what the business is really worth i.e. conducting an independent valuation or market appraisal

2. Understanding how the business appears to a potential purchaser.

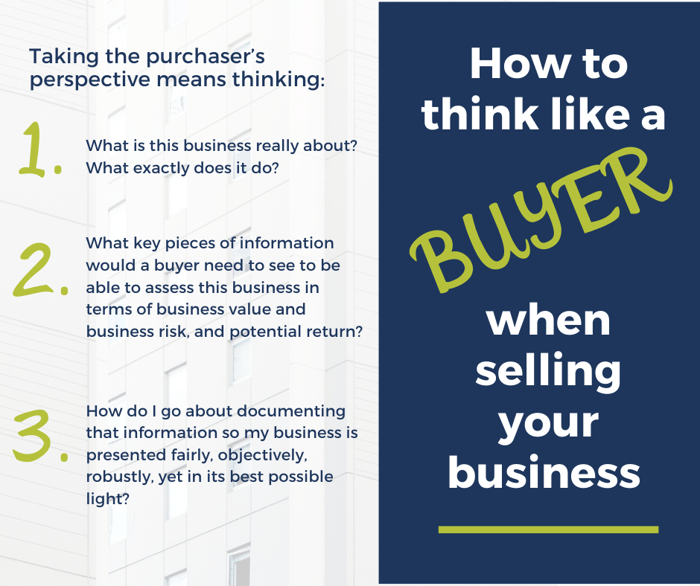

That second component is the core part of vendor due diligence and involves looking at the business from a purchaser’s point of view:

To help you work through those questions we created the Vendor Due Diligence Checklist.

The checklist prompts you to collate the information of most value to potential purchasers, focusing on 6 important aspects of business:

- Customers and markets

- Inventory and suppliers

- People and processes

- Contracts, licences, registrations and agreements

- Business and financial performance

- Other legal information.

Do I really have to do vendor due diligence?

As a seller, you may ask: do I really have to go to the trouble of doing vendor due diligence?

In terms of the first stage – the market appraisal – our short answer is ‘yes’.

We believe it would be false economy not to get a valuation or appraisal upfront, because otherwise you’re flying blind as to what the market will really pay for your business (even though, as we always say, valuation is not an exact science).

The next stage – detailed vendor due diligence prior to going to market – is a judgement call by vendors.

Preparedness for sale is a critical component of maximising value on exit, so, for the business owner who is looking to maximise value and ensure a streamlined sales process, I suspect it is a fairly easy call to make.

If you would like support with any aspect of selling your business, or preparing it for sale, contact the team at JPAbusiness on 02 6360 0360 or 02 9893 1803 for a confidential, initial discussion.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.