Over the years we’ve assisted many clients with decision support around business exit.

Typically we’ve worked with the business owners and their accountants to assess the best way to optimise value when selling their business, or when undertaking a succession process with family members, senior employees or investors.

In these circumstances we've found the following factors are critically important:

- Value – the fair market value of the business (assessed on an independent basis)

- Market position – how the business is positioned in the market and who are targeted as potential acquirers

- Structure – existing business structure (ownership entity) and how that may impact taxation on sale proceeds

- Basis of the transaction – whether shares in a company or units in a trust that owns the business assets are sold, or the underlying assets are sold directly (out of the ownership entity/ies), or a mix of these methods. (Sellers and buyers often have different views about which is optimal – see section below for explanation of why this is the case.)

- Capital Gains Tax (CGT) outcome – as a result of the 4 points above.

How to minimise CGT when exiting your business

Tax considerations – particularly CGT – are very important for anyone considering changing their business structure, divesting or selling part or all of a business as a result of retirement, change of career, succession planning, etc.

In this situation it’s wise to seek your tax advisor’s assistance in looking at the options associated with a business sale.

The following information comes from our ebook, Capital Gains Tax - Issues to consider when selling a small to mid-sized business.

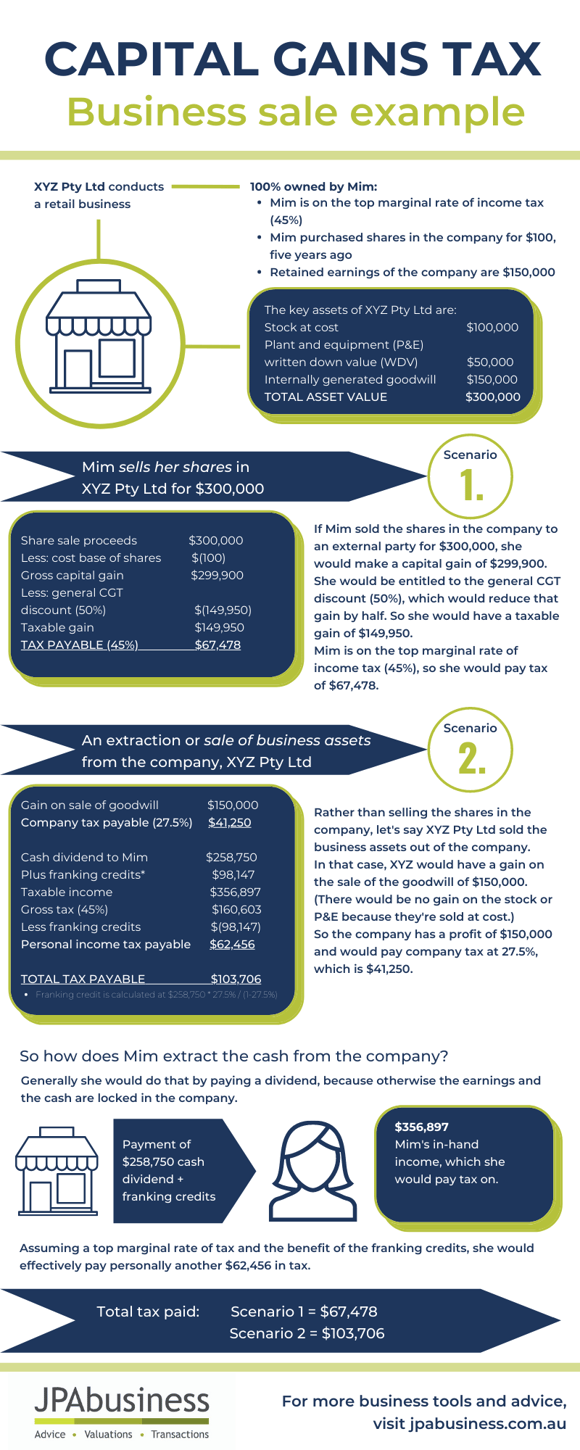

If you conduct a business out of an entity, such as a company, the tax implications of selling the company’s shares, as opposed to selling the business’s assets out of the company, are very different.

Depending on circumstances and the size and complexity of a transaction, a purchaser may prefer to buy business assets, as opposed to the shares or units in the ownership entity, whereas such a deal structure may not best suit a seller.

One of the reasons for this is that if you sell business assets out of an entity you have to deal with extracting profits out of that entity, whereas if you sell shares in a company there can be easier access to CGT concessions.

From a tax perspective the outcomes can be vastly different. Here's an example:

Plan for success

As we said earlier, preferences in selling the business ownership entity versus the business assets out of the entity often sets up a potential conflict between acquirer and seller.

The moral is that it requires quite a bit of planning, which should be done prior to negotiations taking place.

While tax matters don’t impact the market value of the business, prior advice can help optimise the outcome and shape the sales pitch process.

For advice on issues to consider when preparing your business for sale, contact the team at JPAbusiness on 02 6360 0360 for a confidential, obligation-free discussion.