Interest rates are at record lows in Australia right now and, to address the various impacts of COVID-19, the Commonwealth Government has introduced a number of programs to kick-start and boost the economy, including the Coronavirus SME Guarantee Scheme.

Some might argue there’s never been a better time to borrow money to invest and grow your business!

Launched in March, the SME Guarantee Scheme was designed to help otherwise viable SMEs weather the devastating impact of COVID-19 and rebuild for the future.

Phase I ran until September 30 and was not broadly taken up – less than $2 billion of the $40 billion allocated was approved for payment.

Phase 2 began on October 1, with new criteria that means more small to medium-sized enterprises are now eligible.

This phase will run until June 30 2021 and has some amendments that may make the scheme more appealing.

So, who is eligible and what can the loans be used for?

Here are a few facts and figures about Phase 2 from The Treasury website:

- SMEs, including sole traders and not-for-profits, with a turnover of up to $50 million are able to apply for loans under the scheme.

- Loans can be used for a broad range of business purposes (including working capital, capital expenditure, supporting business acquisition and to purchase owner-occupied commercial property).

- Borrowers can access up to $1 million in total.

- Loans are for terms of up to five years, and a repayment holiday is not required but can be offered at the discretion of the lender.

- Loans can be either unsecured or secured (excluding residential property).

- The interest rate on loans will be determined by lenders, but will be capped at around 10 per cent.

Preparation still key

The Coronavirus SME Guarantee Scheme is designed to help lenders provide cheaper credit to businesses by providing a 50 per cent government guarantee to strengthen the credit assessment i.e. the government is taking some of the credit risk in order to promote credit flowing in the economy.

What it isn’t doing is changing the way business owners and managers need to prepare when seeking to borrow money – pandemic or no pandemic, the fundamentals of applying for a loan when you’re in business remain the same.

When considering whether to invest in your business and seek finance, either through this current scheme or more broadly, you’ll find that a bank or financier will usually focus on three S’s:

- Servicing

- Security

- Surety.

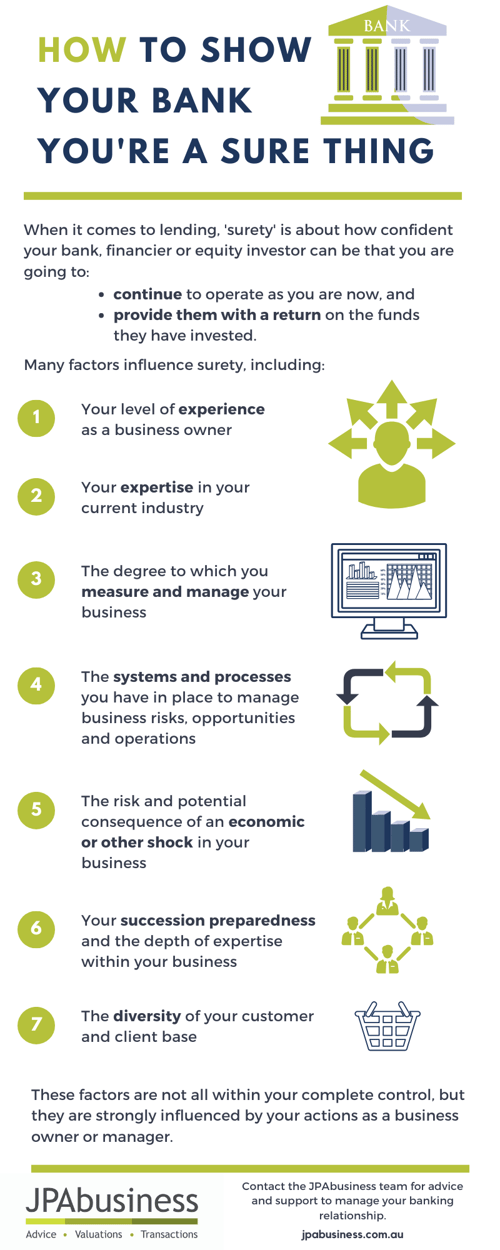

The infographic below sets out 7 factors which contribute to your ‘surety’ in the eyes of a bank or other financier:

Communication key to surety

A key contributor to your ‘surety’ is the information you as a business owner provide to your lender or investor.

Your financier doesn’t want to see you fail, but they can’t impact the business like you can because they’re on the outside. They only know how they experience you as a customer, and what you tell them.

Partnering with your bank

As we’ve discussed in previous blogs and eBooks, there is a lot you can do to influence a bank’s ‘appetite’ for lending to your business. Here are some resources to get you started:

- eBook – Managing your banking relationship

- blog/infographic – How to influence your bank’s lending appetite

Other resources

- SME guarantee scheme fact sheet – Supporting the flow of credit

- SME guarantee scheme website – Frequently asked questions

For more advice about managing your banking relationship and putting a proposal forward for business finance, contact the team at JPAbusiness on +61 2 9893 1803 for a confidential, initial discussion.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.