Over the past few years we’ve produced a number of resources to help our readers and clients navigate the business sale journey.

For the record, Step 1 of selling is always the same: Ask yourself ‘what is my objective in selling?’ Why you are selling needs to be very clear in your mind, and the minds of your spouse, shareholders, business partners and so on, in order to set yourself up for a successful sale.

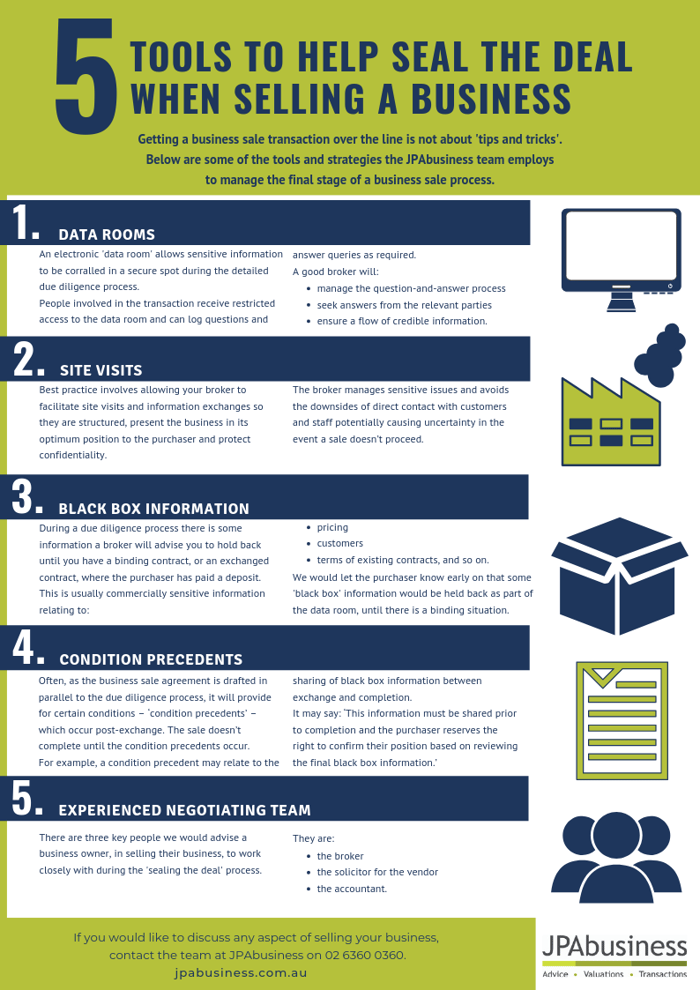

At the other end of the selling process is ‘sealing the deal’ and this is not without its challenges. The cheat sheet below introduces some of the tools we use to manage information flows during the detailed due diligence process and, ultimately, seal the deal.

Transparency critical to selling success

Sometimes, despite everyone’s best efforts, sales unravel for very plausible reasons. For example, the purchaser, despite their genuine interest, finds something about the business during their due diligence that causes them to reconsider.

Or the purchaser, despite what they’ve told the vendor and their broker upfront about their finance capability, in the final analysis is unable to get finance.

A good broker will do their best to identify these issues early and flush them out.

As an advisor to business, whether it’s on the broking side or the advisory side, I always work on the basis of transparency.

If the parties are transparent with each other in terms of their intentions, right from the start, there is a much better chance of either a ‘happy marriage’, or a mutual understanding that it is not going to work out.

If you would like advice about any aspect of selling a business, contact the team at JPAbusiness on 02 6360 0360 (Orange) or 02 9893 1803 (Parramatta) for a confidential, obligation-free discussion.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.