Many business owners, in small and large firms, don’t really focus on their balance sheet. They look at their profit and loss and, if they’re making a profit, they think ‘everything’s fine’.

From our experience, the balance sheet of a business is often the key to its success.

This is because a healthy balance sheet is often the key to being able to withstand shocks; it gives financiers the confidence to support your business with additional funds when things are tight.

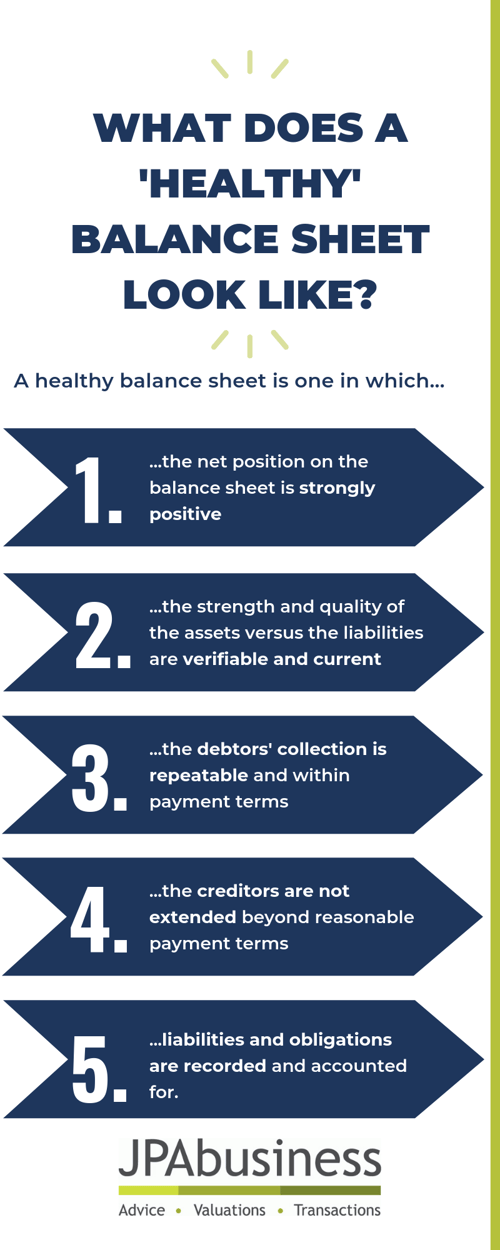

The following infographic features 5 indicators of a healthy balance sheet.

How to influence your bank’s appetite for lending

In our free ebook, Managing Your Banking Relationship, we outlined our top tips for controlling your bank’s appetite for lending.

A bank, financier or equity investor focuses on three S’s when considering their appetite for your business. They are:

- Servicing

- Security

- Surety

A healthy balance sheet is key to ensuring the second ‘S’ on that list, your security, is in a positive position.

If you would like advice or support about any aspect of managing your business, contact the team at JPAbusiness for a confidential, initial discussion.