We are often engaged by business buyers to assist them in undertaking due diligence on target businesses.

In the early stages of that process I often come across vendors who have an accountant, business broker or other advisor who is very coy about sharing what I would call basic financial information on the business.

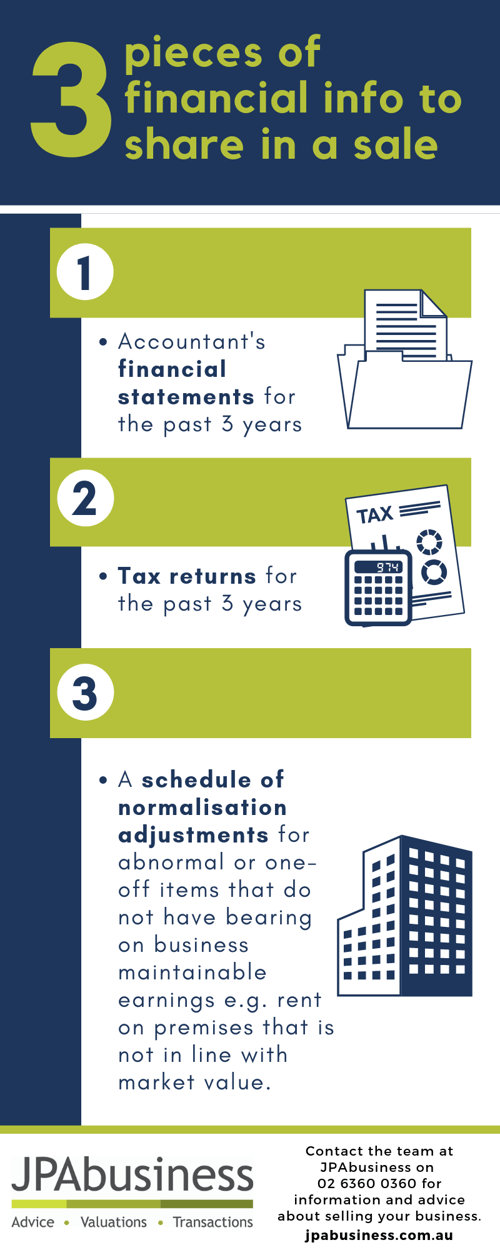

If you are seeking a purchaser’s genuine offer on your business – whether non-binding or binding – at a minimum, you should be prepared to share the following:

Why do I need to share this information?

From a communication perspective, having an open and transparent flow of information right from the start builds trust and lays the foundation for a good working relationship and negotiation framework for the two parties.

While sharing this information may seem controversial to some people, withholding it limits the purchaser’s opportunity to undertake a robust initial assessment and put their best foot forward in terms of a potential offer.

Here's an example:

I had an instance recently where a vendor was refusing to share basic financial statements and instead their advisor put together a summarised table of financial performance.

Based on that limited information, they were seeking a binding offer from the purchaser.

My advice to my client was to be very cautious about proceeding and investing time and effort in considering the acquisition opportunity, when the vendor and their advisors were reluctant to share base-level, important information on which to make a financial assessment of the business i.e. tread carefully!

How can I safeguard my valuable information?

Make no mistake – I am not advising that you give away sensitive, commercially critical information to anyone who walks in the door.

As I have said before, I shudder when I hear of business owners who have shared detailed financial and business information to a competitor, or a party that has approached them directly to buy their business, without any form of documentation or pre-qualification.

However a good business broker or advisor will have a robust prequalification process in place that includes executing a confidentiality agreement – make sure you discuss this issue when assessing potential brokers.

(We have discussed prequalification in depth in a number of blogs and in our eBook, Selling a Business – What works, what doesn’t and how to avoid the common pitfalls.)

Once an interested party has been prequalified, found to be genuine and has signed the required confidentiality agreements, then it is good practice, in my view, to share the financial and tax statements listed above.

If you would like advice about any aspect of buying or selling a business, contact the team at JPAbusiness on 02 6360 0360 or 02 9893 1803 for a confidential, obligation-free discussion.

.jpg?width=1000&name=action-adult-agile-316769%20(1).jpg)