Goodwill is a key component of business value, alongside factors such as working capital, and plant and equipment.

Many people think of goodwill as an ‘intangible’ and therefore its value can’t be proved, but that's not necessarily the case.

Goodwill value relies on being able to prove the sustainability of a business’s earnings going forward.

In this blog we’re going to explain how record-keeping is a critical component of proving that sustainability, and provide some simple templates to get you started.

A quick caveat: this approach won’t suit some businesses, such as those in the traditional B2C sectors of retail and food service (unless it’s an event-based business). However, it should apply to most B2B sectors.

How to show sustainability of earnings

To determine the sustainability of a business’ earnings beyond its current ownership, we turn to the concept of future maintainable earnings (FME), or business maintainable earnings (BME).

(Take a look at some of our past blogs for a detailed explanation of what determines BME.)

Key to proving FME/BME to potential purchasers is diligent record-keeping on three critical elements of your business:

- work in progress (WIP);

- pipeline, and

- contracts.

As we drill down into each of these, we’ll use the example of Construction Business X, which has averaged EBITDA of $3.75 million per annum over the past three years.

Work in progress (WIP)

These are projects or jobs you have won, which are partially completed and may also be partially invoiced.

For example, Business X has won a $20 million project to build a block of apartments. 50% of the physical work has been completed and 70% has been invoiced.

(Note to potential buyers: if you are acquiring a business with a WIP situation like this – 50% per cent of work still to be done, but only 30% of income to collect – make sure the people doing your due diligence uncover it. Often in a sale process we will negotiate an adjustment to a purchase price at completion, where these things don’t line up. Unless your advisor has uncovered it, you won’t know until it’s too late.)

WIP also includes confirmed forward orders – the money is not guaranteed, but there is a high likelihood it will end up in the business owner’s bank account.

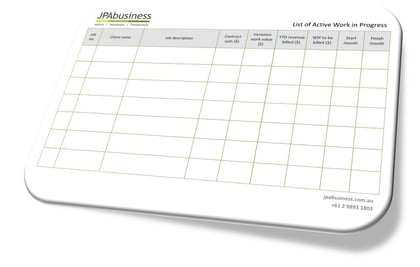

Use our template to record your list of active WIP.

Pipeline

Your pipeline includes the projects and jobs you have submitted tenders or quotes/proposals for, but which have not yet been awarded, the value of those tenders, and the likelihood you will win them.

For example: Business X has tendered for 15 projects with a total value of $120 million and which are due to be awarded over the next three months.

Based on Business X’s past form, which the managers have diligently recorded, the possibility of success (the ‘win rate’) for those projects is 20% (i.e. two project wins per 10 projects tendered).

20% of $120 million is $24 million.

So, the likelihood is Business X will win $24 million worth of tendered projects in the next three months (i.e. this level of business is likely to flow through to the business’ WIP over this period and beyond).

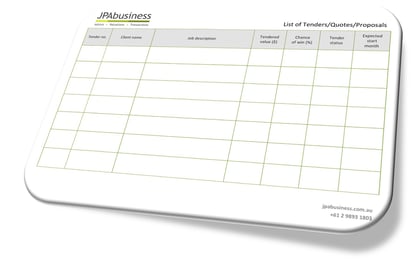

Use our template to record the tenders, quotes and other proposals in your pipeline.

"What’s your win rate?"

When valuing a business, we’ll invariably ask a business owner: “What’s your win rate on tenders?” Often, they’ll look at us vaguely and say: “I don’t know – we only care about the tenders we win.”

It’s critical to document all tenders – successful and unsuccessful – to enable you to prove your win rate to potential purchasers doing due diligence. No one likes uncertainty when buying a business and providing this data will remove guesswork on their behalf. It’ll also help you identify areas for estimating and tendering improvement that may help increase your win rate over time.

Contracts

Some businesses have service contracts with clients which are based on a fixed or hourly price, and which can provide the business with a level of certainty about the amount and timing of revenue for a set period.

For example: a fire safety business may have a three-year service agreement with a group of offices which requires them to test exit signs, suppression units and so on every second month.

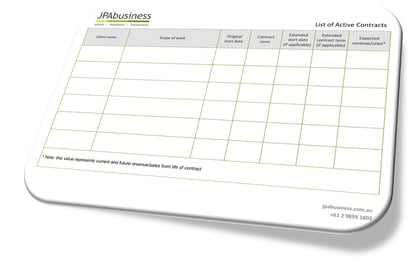

Use our template to record your active contracts.

When there is no contract

In terms of surety around the value of your forward orders, a contract is the ideal. The reality, however, is that often businesses offering similar services won’t have written contracts. What they may have, though, is a reasonable degree of certainty around ongoing and future sales with repeat clients.

They may tell us: “Client A has purchased between $20,000 and $40,000 worth of goods from us each year for the past three years. We expect they will purchase at least another $20,000 worth of goods this year.”

If they have clearly and rigorously documented these sales and this client relationship then, as a valuer, I will feel relatively confident about the sustainability of these potential future earnings – certainly a lot more confident than if they weren’t documented!

Looking forward, looking back

As a business valuer I often need to have difficult conversations with clients who assume their business value will be based purely on past performance.

They look longingly at past results and say: “Based on those fantastic results I think my business should be worth X. Why are you saying it’s only worth Y?”

My response is: “I’m sorry, but someone coming into the business will not see the benefit of those past earnings. You’ve had the benefit of those. You’ve paid your tax, got the retained earnings and either invested them in the business or elsewhere.

“A buyer is only interested in the extent to which those reported earnings can be repeated in the future.”

Being able to prove repeatability of earnings – with data and rigorous record-keeping – is key to maximising value on exit.

You don’t have to sell to reap the benefits

Our experience is that businesses often fail in this area of information management and reporting, whether they have a turnover of $500,000 or $350 million.

It may be because businesses are often focused on financial accounting, which is usually done in the ‘rear vision mirror’: we put our heads down, do the work in front of us, collect our payment at the end, then report on it.

But as owners and managers we need to be equally focused on reporting what’s coming up: what’s scheduled? What does the pipeline look like? How does it match our capacity? How will it impact cashflow?

Forward-looking reporting processes that focus on WIP, pipeline, contract management, resource management, and job and project delivery are key to proving sustainability of earnings, and they’re also critically important in terms of successful day-to-day management.

Ultimately these processes will allow you as a business owner or manager to enhance business value as you operate the business, as well as on exit in terms of goodwill paid in recognition of sustainable earnings.

If you would like advice on business value, goodwill in your business, earnings sustainability or exit options, contact the JPAbusiness team for a confidential, obligation-free discussion.