From a day-to-day point of view, the more cash surplus in your business, the more value in your pocket. Having surplus cash that can be used as working capital also gives your business more options to grow, invest and change.

Taking the longer-term perspective, ability to generate cash is a critical component when it comes to determining the value of the business should you wish to exit.

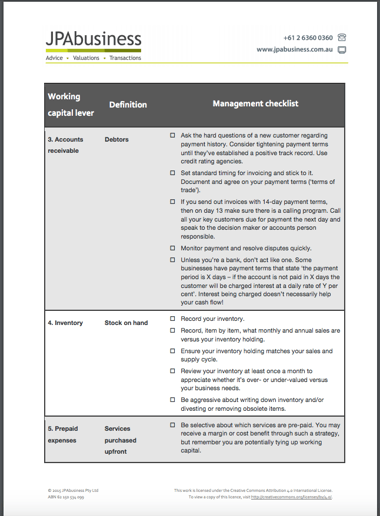

As a business owner or manager, there are a number of 'levers' you need to control to successfully manage working capital and drive a successful, cash-generating business.

As our Working Capital Checklist shows, those levers fall into two buckets: current assets and current liabilities.

On the Current Assets side, the levers include:

- Cash and cash equivalents

- Short-term investments

- Accounts receivable

- Inventory

- Prepaid expenses.

On the Current Liabilities side, the levers include:

- Accounts payable

- Short-term debt

- Current commitments

- Salaries

- Taxes and regulatory and statutory payments.

You can use the free checklist to assist you in achieving a firm control of your working capital levers and cash position, so your business proposition is not hampered by poor cash flow.

How cash flow impacts exit plans and purchase price

While these levers contribute to the daily value of your business, they’re also critical to your succession and exit plans – to your ultimate business value.

Banks and potential purchasers will all want to assess your Business Maintainable Earnings (BME), which is essentially a measure of cash generation in the business.

If you would like support or advice regarding working capital and cash flow management, contact the team at JPAbusiness on 02 9893 1803 or 02 6360 0360 for a confidential, obligation-free discussion.