Business market appraisals and valuations are both robust assessments of a business’ worth and are appropriate for use in different circumstances.

In this video I explain the difference between a business market appraisal and a business valuation, and when each should be used.

If you are seeking an 'indicative view' of a business' value, then a market appraisal is a cost-effective means of achieving this.

A sworn valuation is appropriate if you are seeking a document that can do the following:

- stand up in a court of law

- be presented to a bank for finance purposes

- be used to help settle a dispute

- support a share or purchase transaction.

A sworn valuation (conducted by a Certified Practising Valuer) is much more detailed than an appraisal. It comes with a specific value related to the business and verifies that value against the methodology used by the valuer.

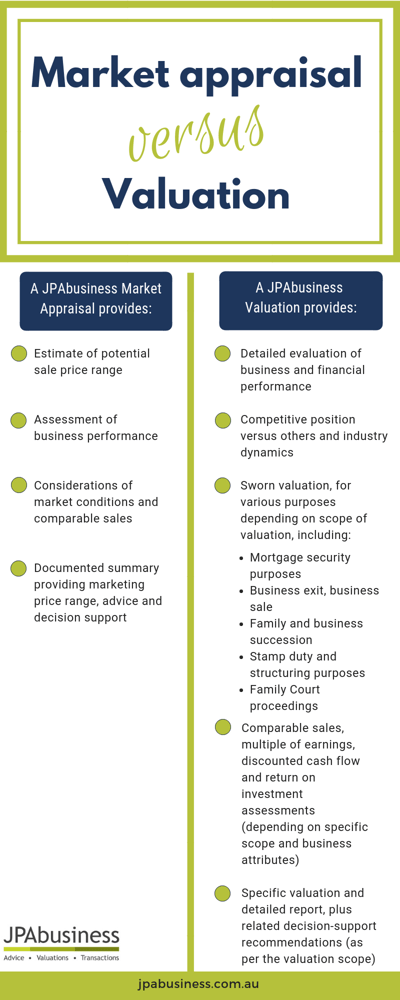

The following infographic summarises the differences you can expect to see between a JPAbusiness Market Appraisal and Valuation:

If you are interested in seeking a market appraisal or valuation for your business, or for a business you’re considering purchasing, contact the JPAbusiness team on 02 6360 0360 (Orange) or 02 9893 1803 (Parramatta) for a confidential, obligation-free discussion.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.