Business market appraisals and valuations are both robust assessments of a business’ worth and are appropriate for use in different circumstances.

In this video I explain the difference between a business market appraisal and a business valuation, and when each should be used.

If you are seeking an 'indicative view' of a business' value, then a market appraisal is a cost-effective means of achieving this.

A sworn valuation is appropriate if you are seeking a document that can do the following:

- stand up in a court of law

- be presented to a bank for finance purposes

- be used to help settle a dispute

- support a share or purchase transaction.

A sworn valuation (conducted by a Certified Practising Valuer) is much more detailed than an appraisal. It comes with a specific value related to the business and verifies that value against the methodology used by the valuer.

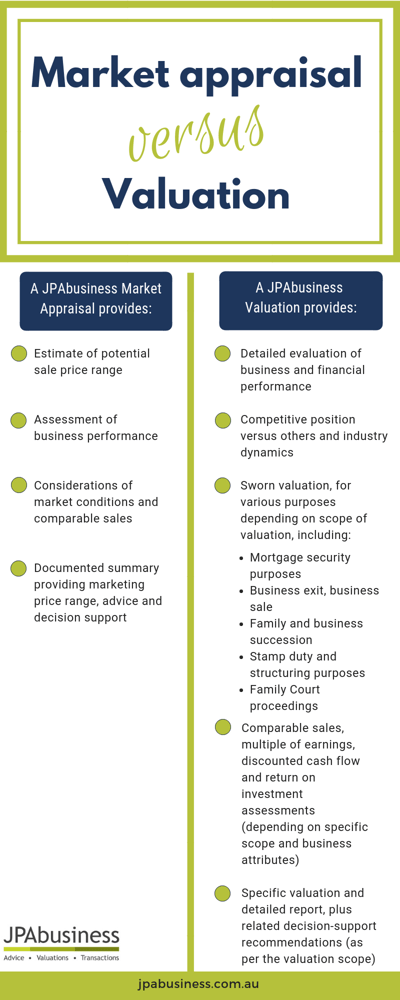

The following infographic summarises the differences you can expect to see between a JPAbusiness Market Appraisal and Valuation:

If you are interested in seeking a market appraisal or valuation for your business, or for a business you’re considering purchasing, contact the JPAbusiness team for a confidential, obligation-free discussion.