There are 5 key Business Health Factors we examine, alongside financial accounts, to really understand what is driving a business, whether it is for valuation or business advisory purposes.

If you want to improve your business’s operational performance, these are areas you should focus on too:

- Customers – strength of relationships and level of diversity

- Suppliers – level of reliance, spread of coverage and stability of supply chain arrangements

- People – concentration of responsibilities, engagement and retention, culture and productivity

- Delivery – project, job or activity level performance versus budgets, service levels and client feedback

- Pipeline – work in progress and forward outlook, contracts, and tenders and prospects.

In this blog we’re going to drill down into each of these health factors and provide some advice on how and when to manage them. We’ve included a link to our free timetable of actions to help with this process.

The following information comes from our free ebook Tips to improve financial and operational performance.

Customers

When dealing with clients for valuation or advisory purposes, many of them want to tell us about their sales figures. If sales have increased from last year, they celebrate.

We say: “That’s great, but we’re more interested in the quality of that revenue (i.e. their customer portfolio and the sustainability of performance going forward) than the simple dollars (i.e. the sales figures).”

We want to know:

- Who are your top customers?

- What is the mix of revenue from sales – concentrated on a few clients or broadly spread?

- How much do they spend each year and how regularly?

- Is that spend trending up or down?

- How are gross profit margins looking at the customer level?

Other ‘thought starters’ to consider in running your business and managing your customer portfolio include:

- What information do you track on customers on an annual basis?

- Do you know the extent to which customers are repeat purchasing?

- Do you understand the trends that are impacting your customers?

- Do you make any management, sales or marketing decisions based on the performance of your customer portfolio?

- Have you broken down your sales figures into business lines, products or industry sectors?

That’s the level of reporting and analysis that needs to be done by a business owner or manager to really treat your revenue pool as a portfolio, and understand the different risks and values and returns it offers.

Suppliers

While a customer portfolio is a dynamic entity, like a share portfolio, and needs to be reviewed regularly, the ultimate goal with suppliers is more aligned with stability.

If you’re lucky enough to have a business that has few constraints regarding where your supply of products/services comes from, then reviewing your supply relationships and agreements annually is probably enough.

However if you are heavily reliant on just one or two suppliers to provide a key component or ingredient for your product, you should be monitoring and reviewing those supplier relationships at least quarterly.

You should have agreements with those key suppliers that provide continuity of supply, and also have reliable back-up suppliers in the case of unforeseen disruptions, such as pandemics, floods or political instability.

People

Most successful business owners recognise that their people are their most valuable asset.

When we assess a business, we invariably ask for a fixed asset register. Why shouldn’t businesses hold a register of their people asset, as well?

Every business should hold a simple schedule of their team members that indicates:

- Name

- Date they joined the company

- Role

- Remuneration level

- Key skills

- Training and development provided

- Succession track within the business.

A register of your ‘people portfolio’ provides critical, base level information in the context of training, professional development, and succession planning.

It helps identify where you have skills gaps in the business, and who might be ready to step up if the business leaders were suddenly out of the picture.

Delivery

Delivery involves oversighting how your value proposition is being delivered to your clients, and how they receive it. Consider questions such as:

- Do your delivery systems and processes allow for consistency, scale and efficiency?

- Is your inventory well-managed so customer wait times are limited, by capital is not excessively tied up in stock?

- How are clients receiving your product/service? Are you actively seeking their feedback? If it’s negative, what are you doing about it?

Adopt a culture of continuous improvement

Every project or customer interaction should have some level of learning and continuous improvement associated with it.

Some businesses have a performance recording system that allows project budgets to be reported on versus actuals, and that is certainly helpful in terms of reviewing project performance.

However continuous improvement is as much a business culture issue as it is a performance recording issue. It’s about learning from mistakes and failure and using those situations to enhance future performance.

Good businesses that don’t have access to high-level data can still have a culture of reviewing projects and trying to learn and improve as a result.

Here’s an example, using a building project:

After completion, the team sits down and asks the following:

- What was the objective?

- What was the budget?

- When everything was done and we collected the revenue and paid all the bills, got all the machines and the people back, how did we go?

- Did we improve the margin on the project versus what we budgeted for (by better purchasing, perhaps)?

- Did we run over time?

- Did we have any work-site injuries?

- Did we upset the client, or is the client now referring other business to us?

I’ve used a building project as an example, but the same applies to reviewing a sales force’s sales performance, or assessing how well a retail outlet handles customer complaints, or in fact a property or professional services business, or any other industry sector.

It comes back to how do you make people accountable for delivery and therefore enhance their satisfaction – and future performance – if they deliver or exceed the budget. And it’s not just the sales budget; it’s also about whether they delivered the ‘value proposition’ and represented your brand as intended.

Pipeline

We talked a lot about pipeline in our ebook, How to give your business a strong forward outlook, and provided templates to help monitor and record it.

Ultimately, it’s about what visibility and intelligence you have about the likely prospects of your business beyond today.

Many business owners will say: “It’s in the lap of the gods, anything can happen.”

That’s true to some degree, but the very best business owners still have a high degree of confidence and knowledge about the likely prospects of their business moving forward. They make it their business to figure that out – and their companies usually attract higher values as a result.

Tracking and recording the key elements that contribute to your forward outlook – work in progress, contracts, tenders and prospects – makes you a better manager because you can make decisions about resourcing and plan business activities.

Sure, there is some risk about those things occurring, but the good business owners ensure they get enough information about their forward prospects and what’s happening in the market to make ‘educated’ decisions.

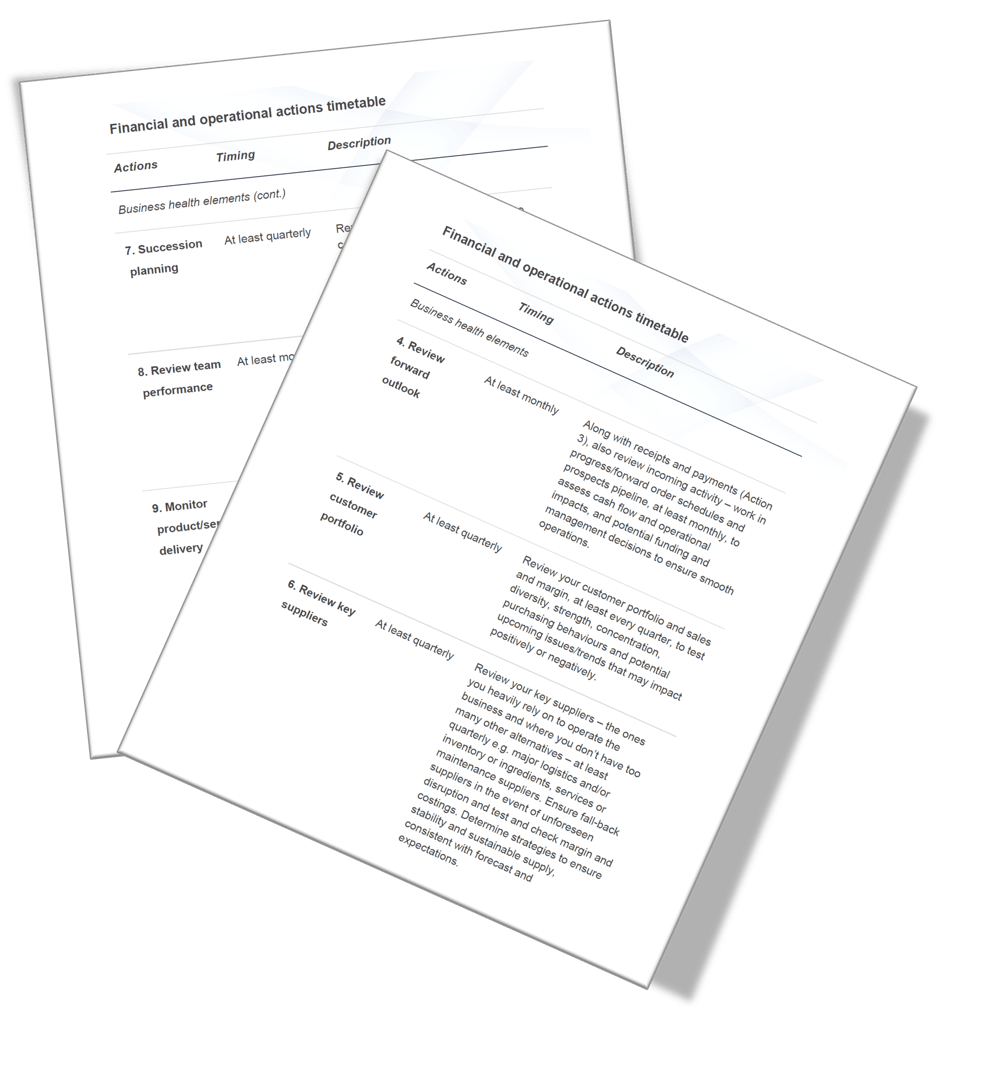

Use our Financial and Operational Actions Timetable

Every business is different and every business owner has different goals, objectives, priorities and schedules.

In working with clients over many years, we have learned that, despite these differences, it is critical for financial and operational performance to have discipline and a deliberate focus around the key elements you monitor, review and address as an owner or manager.

Our free timetable covers the critical items to focus on in running and managing a business.

If you would like to improve your business’s financial and operational performance, we’re keen to help you. Feel free to get in touch by calling 02 6360 0360 or 02 9893 1803 for a confidential, obligation-free discussion.