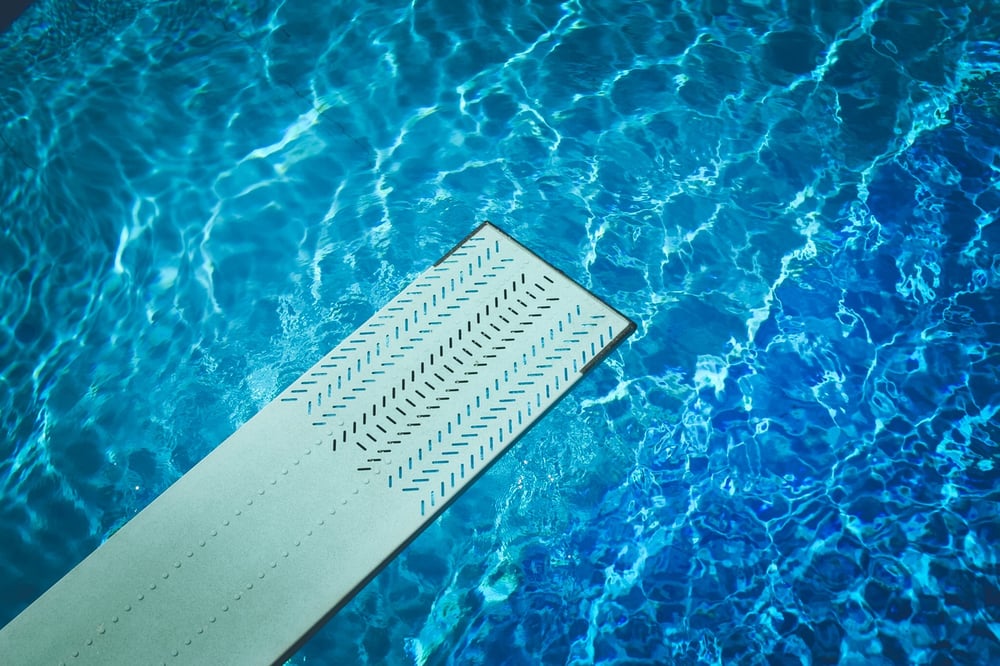

Whether you are buying a business or selling a business, making a match between the buyer’s and seller’s goals is a bit like an Olympic diving competition – it's all about degree of difficulty.

Maximising value (for all) is about finding that neat alignment between difficulty, precision, execution and overall delivery; ensuring the approach is smooth, the execution is seamless and there is limited splash on entry!

It’s that unique situation where ‘positive tension’ is created when there is a win-win result. The most difficult dive (e.g. an above-market price) is not necessarily the best outcome, but nor is the least difficult dive (e.g. receiving all the proceeds upfront).

And, finally, striving for a gold medal (e.g. highest price/lowest price) doesn't necessarily make you a winner. A bronze (e.g. fair price and equitable terms) could be the optimal outcome, in terms of the value, terms and conditions, and the likelihood of a successful transaction.

Experience counts

One of the great delights of being a business advisor and broker is the variety of clients I meet and work with to achieve their business succession and exit objectives.

In the past week alone our team has worked on projects relating to businesses operating in Queensland, NSW, South Australia, Victoria and New Zealand. These firms were involved in everything from safety products, fruit distribution and electronics systems maintenance, to manufacturing, labelling and identification, hospitality, civil construction, mining and the retirement sector.

Over the course of this busy week I've been asked several times: what are the main ingredients needed to achieve a successful business merger, acquisition or sale?

Based on our years of business broking experience – and successfully making a match between many buyers and sellers – answering ‘yes’ to the following three questions should set you up for a perfect ‘dive’!

- Price – Is the price market related and does it reflect the value a willing buyer, under the circumstances of the sale transaction, will perceive?

- Facts – Are the facts on the business or opportunity clear, unambiguous and relevant to the risks, issues and opportunities the risk-taking party will likely perceive in making the purchase?

- Representation – As a business seller or purchaser, do you have the right representation to qualify the opportunity, risks and issues, and who understands your business, industry, needs and objectives sufficiently to be able to guide and facilitate a negotiated outcome that makes a lasting match?

If you need the right representation and advisory services on the sell or buy side of a business transaction, JPAbusiness would be pleased to help. Please contact our team on 02 6360 0360 or 02 9893 1803 for an obligation-free, confidential discussion.