Put simply, the market value of your business is the amount a buyer is willing to pay for it.

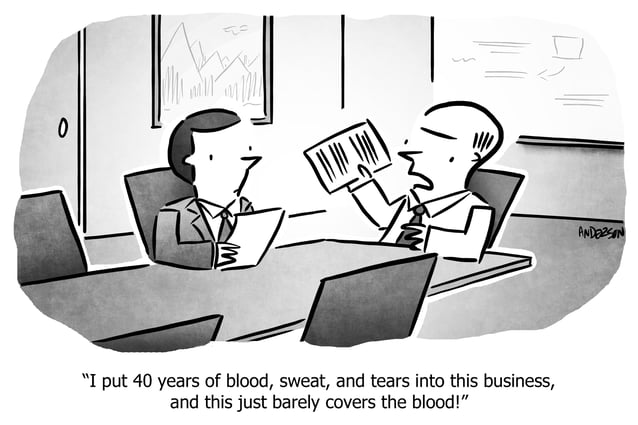

It’s a hard pill for many vendors to swallow, but chances are a buyer will perceive the elements of your business’ value differently to the way you see them.

Here are some of the reasons why:

- an owner will inherently have an optimism bias, while a potential purchaser will inherently take a more cautious view

- an owner and a buyer may perceive financial results differently and they may have differing views on business risk

- owners often let factors such as the time and effort they have put into the business, as well as business debt, impact their perceived value of the business – a potential purchaser is unlikely to see those elements as relevant at all.

These discrepancies may lead to a business owner’s expectation of business value differing to the market value of the business.

If you are considering selling, a JPAbusiness valuation or market appraisal will provide a realistic view of your business’ potential sale price range, based on the business’ performance, market conditions and comparable sales.

Contact the JPAbusiness team on 02 6360 0360 for a confidential, obligation-free discussion.

Related resources:

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.