We are often approached by private companies looking for advice about setting up incentive arrangements for their employees, including issuing shares to provide a form of ownership.

These companies tend to have turnovers ranging from about $5 million to well over $100 million, but they all share an interest in achieving closer alignment between their people and their company visions.

We tell these clients and prospective clients, issuing shares can be an effective means of aligning and incentivising employees, but it’s not the only option.

In this blog I’m sharing excerpts from some work we’ve done in response to some of these inquiries, which outlines a range of options when creating an employee incentive plan (EIP).

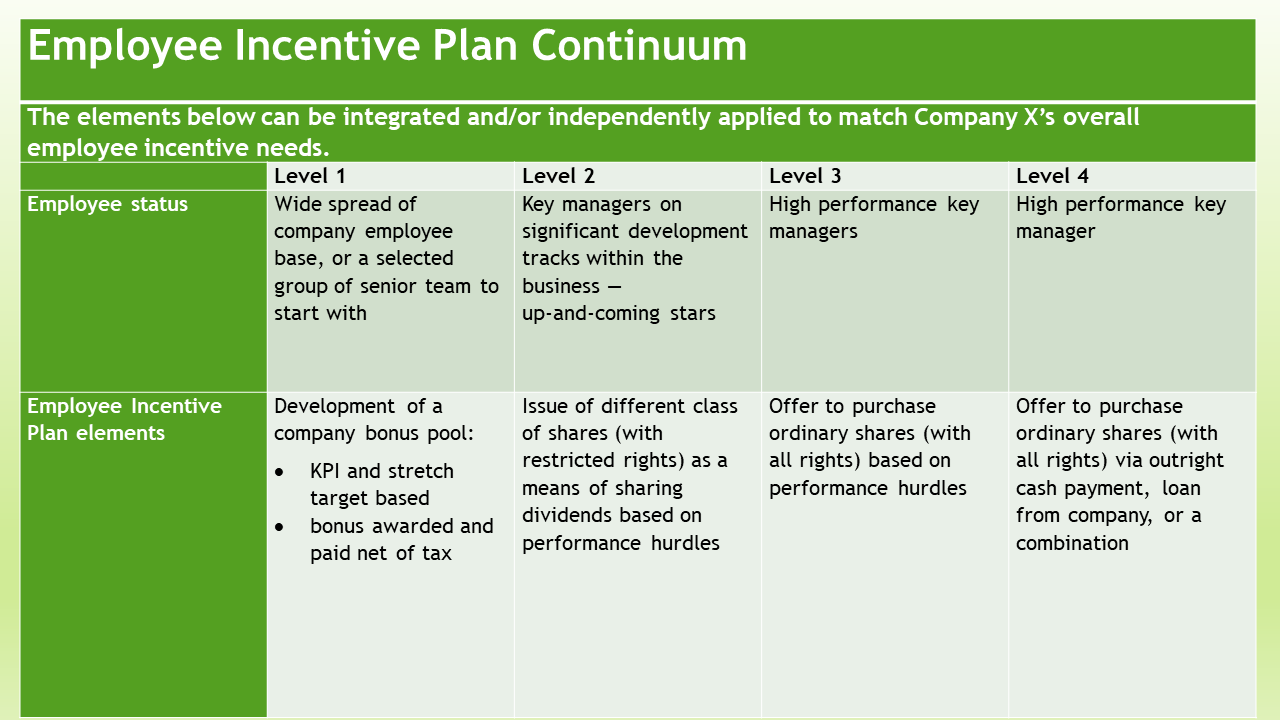

In our experience an EIP should ideally have a continuum of elements – right from well-structured and well-measured bonuses, through to various share equity ownership alternatives.

It’s often a balance between having mechanisms to motivate and reward individuals – everyone is different in the way they might respond – and also aligning teams to culture, expectations and business directions.

Key features of an employee incentive plan

- An effective EIP should have a mix of:

- short-term incentive elements linked to annual business objectives, and

- long-term incentive elements that support shareholder value and sustainable practices.

- The plan can apply across the entire business, or to specific employees or groups of employees.

- Directors decide which employees might be eligible for which elements. (This may change year on year depending on results/performance, forward plans and individual employees’ progression and aspirations.)

Below is a continuum of incentive mechanisms we recently designed for a client in the automotive parts distribution sector – called Company X here for privacy reasons.

Developing a company bonus pool

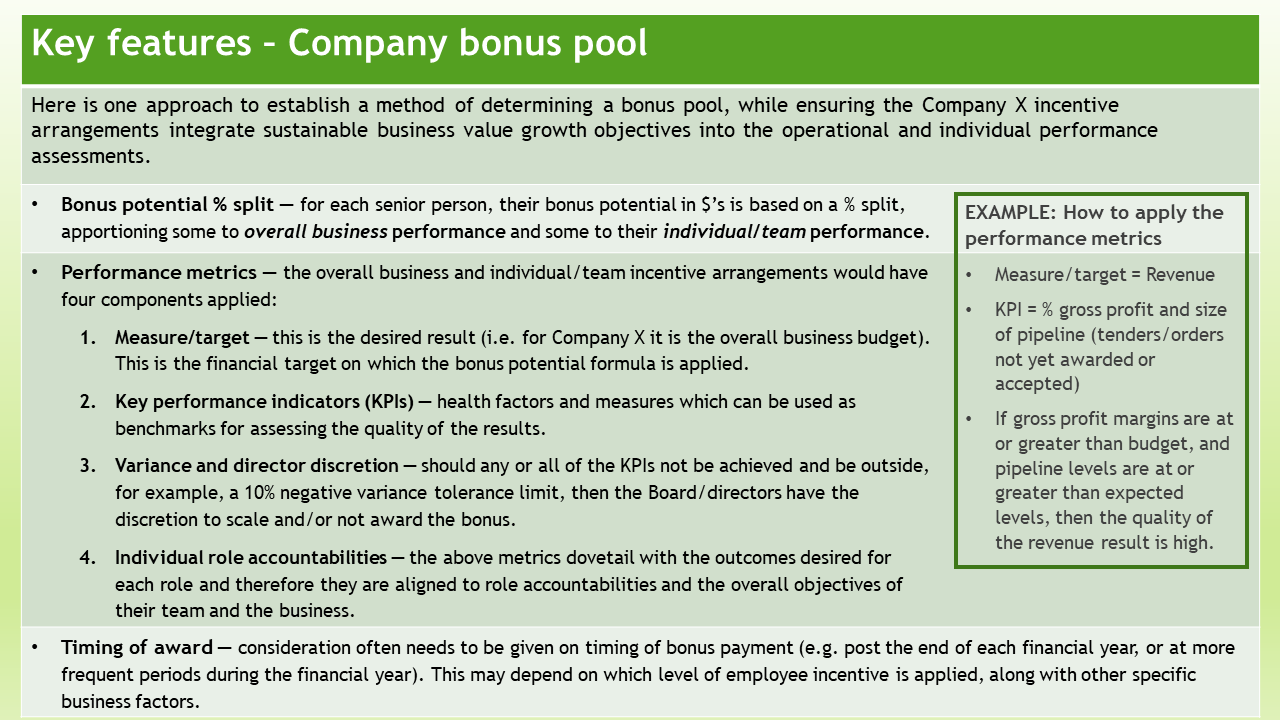

Regardless of level (i.e. 1, 2, 3 or 4, as above), we advise clients in the strongest terms that awarding a bonus, in the form of a payment net of tax (i.e. Level 1) or issuing a different class of shares (i.e. Level 2), or ordinary shares (i.e. Levels 3 and 4), needs to represent a reward and acknowledgement for extraordinary performance – that is performance above budget.

So with Company X we devised a bonus pool concept to determine the potential value of bonuses on offer in any one year and the basis by which those bonuses would be assessed, measured and determined.

Often the tricky thing with an employee incentive plan of any kind is to establish a working mechanism that is fair, open and transparent to the employee, as well as accretive in value to the company.

It also has to be reasonably straightforward and simple to administer!

Our client, Company X, used the above elements to develop a bonus pool and assess and award incentives to their senior team, incorporating the approach and detail into their management processes and practices.

They also used our continuum (further above) like a menu in a restaurant – offering particular employees a choice around how their incentive (i.e. bonus) might be paid or awarded, from just Level 1, to combinations of Level 1 through to 4, depending on seniority and other factors.

Share purchase considerations

If employees are offered the opportunity to purchase shares, then – depending on whether the business decides to offer a different class of shares (i.e. with restricted rights) or ordinary shares (i.e. with full rights) – the following points, while not exhaustive, are important to discuss and decide as part of finalising the incentive arrangements:

- Company decision-making processes (i.e. impacts on control and key management decisions)

- Exit provisions, including ‘drag along, tag along’ rights in the event of an external transaction (i.e. business sale)

- Caps on issue of different class of shares and any dilution issues

- Capital Gains Tax (Small Business Concessions) and other tax consideration for the employee and the company

- Reporting provisions and expectations of shareholders

- Business valuation methodology and frequency

- Any provisions to discriminate or vary the rights of holders of the different class of shares against holders of ordinary shares in the event of a wind-up and/or distribution of surplus assets (i.e. via dividends, use of imputation credits, etc)

- Company buyback provision (i.e. in the event of employee leaving, misconduct, other)

- Any consequential changes to Constitution and Shareholder Agreement to implement the incentive arrangements

- The company policy on the offer process and related communication strategy

Top 5 issues when setting up an employee incentive plan

In designing the optimum EIP for any company there are five threshold issues to consider:

-

- An up-to-date valuation of the company and underlying business activities

- Measures, targets, KPIs and monitoring performance.

- Company Constitution and Shareholder Agreement issues

- Tax and compliance impacts associated with issuing shares to employees

- Pros and cons of an Employee Share Scheme (that has specific legislative requirements and features for defined circumstances) versus issue of Ordinary Shares and/or Options

Steady, incremental execution

A word of caution.

We know from experience with many employee incentive plans we have helped clients implement that issuing shares to employees or paying bonuses net of tax are not silver bullets that result in company results leaping to the next level.

Developing a sound EIP is best achieved through an incremental and deliberate approach to improving the way the firm operates and its practices in rewarding staff for extraordinary performance.

It is a marathon not a sprint. Start small and focused, and build up from there.

How we can help

If you would like assistance in developing your businesses incentive arrangements, please contact the JPAbusiness team on +61 2 6360 0360 for a confidential, initial discussion.