As a business owner or manager, there are a number of 'levers' you need to control to successfully manage working capital and drive a successful, cash-generating business.

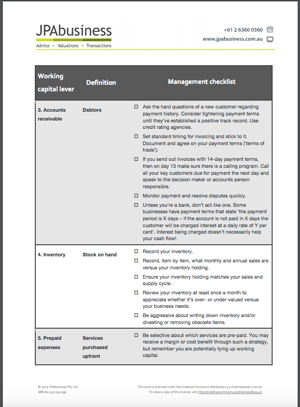

As our Working Capital Checklist shows, those levers fall into two buckets: current assets and current liabilities.

You can use the free checklist to assist you in achieving a firm control of your working capital levers and cash position, so your business proposition is not hampered by poor cash flow.

How cash flow impacts exit plans and purchase price

While these levers contribute to the daily value of your business, they’re also critical to your succession and exit plans – to your ultimate business value.

From a day-to-day point of view, the more cash surplus in the business, the more value in your pocket. Having surplus cash that can be used as working capital also gives your business more options to grow, invest and change.

Taking the longer-term perspective, ability to generate cash is a critical component when it comes to determining the value of the business should you wish to exit.

Banks and potential purchasers will all want to assess your Business Maintainable Earnings (BME), which is essentially a measure of cash generation in the business.

What we look for in the due diligence process

In this section we're looking at some of the key 'working capital levers' typically examined in the due diligence process and how they impact the ultimate price a buyer is willing to pay.

At JPAbusiness we often undertake commercial and financial due diligence for purchasers looking to buy businesses. Some of the key things we examine in a due diligence process include:

- cash flow and working capital

- accounts receivable and payable

- inventory.

Surplus cash

How much surplus cash does the business generate and is that cash generation sustainable?

Often that simple calculation will feed into our view of Business Maintainable Earnings (BME) and therefore significantly impact our perception when advising the purchaser of what the business is worth.

The debtor’s ledger

Also known as accounts receivable, these are the people who owe you money. We look at the strength of that ledger and the ability over time for your customers to pay what they owe to you, on time.

Accounts receivable is one of those assets you might assume can be taken at face value, but what if your debtors aren’t meeting your terms?

Effectively, the debtor’s ledger is a portfolio and if it is out of order by large, significant amounts, you will be penalised. This is because the purchaser is taking on that portfolio of customers and their poor performance in terms of payment.

For instance, if your payment terms with customers are 30 days and your debtor’s ledger shows that 30% of the value of your debtors are overdue by 90 days or more, that will impact your working capital and cash flow.

The risk that a purchaser will perceive is that they won’t get 30% of debtors on a monthly basis, based on what’s occurred to date. We will respond by marking down the value of your debtor’s ledger, from a due diligence perspective.

That’s why a day-to-day lever in this area is so critical to you, the owner.

Inventory

We’ve talked in the past about the face value of inventory versus the real value and how vendors tend to think they have ‘gold’ on the shelves.

Don’t fool yourself by thinking you’ve got X dollars of inventory when the reality is, to run your business successfully, you only need Y dollars.

Be honest and upfront with yourself regarding what the real value of your inventory is.

Put yourself in a purchaser’s position and think: “If I was to buy my business today, how much inventory would I really be prepared to pay for and at what dollar value?”

If you’re not sure, get some advice regarding:

- what a reasonable inventory holding is;

- how to ensure you get the most value out of your inventory, and

- how to dynamically manage it.

Rewards on offer for careful working capital management

All these components are closely watched in a due diligence process by a purchaser and their advisor looking to buy a business. We know because we run those processes for clients and those components go heavily to making up the value exchange in a business transaction.

They’re all levers that can be heavily influenced by a business owner. Yes, they are impacted by market forces, things that happen to suppliers and customers, but largely they can be influenced by you. Ignore them at your peril.

Address them, utilise them, and you will be rewarded with a business that generates cash day to day, and builds value over time.

If you would like support or advice regarding working capital and cash flow management, contact the team at JPAbusiness on 02 9893 1803 or 02 6360 0360 for a confidential, obligation-free discussion.