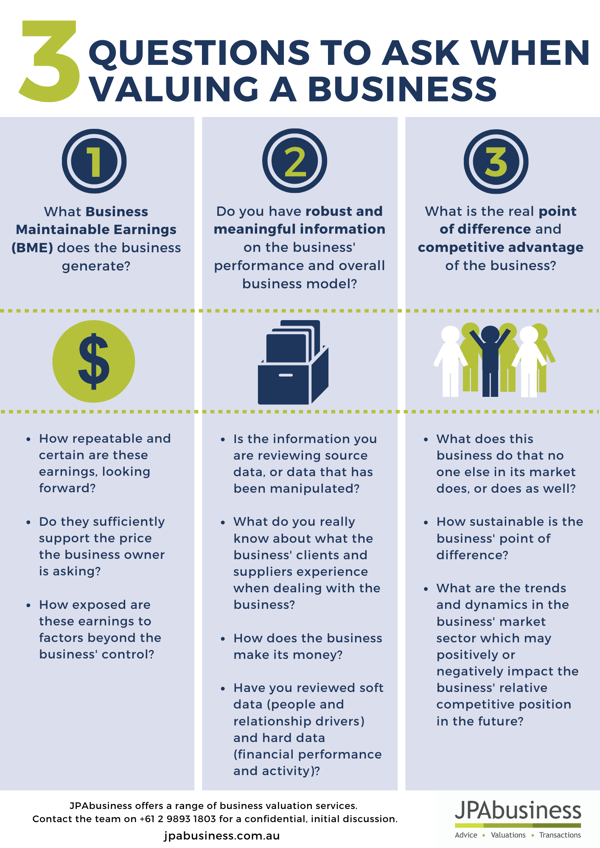

Business valuation is not an exact science and nor is it a simple science. However there are some factors that should always be considered when assessing a business’ value.

They are:

- repeatability of current earnings

- availability of information on the business’ performance and business model

- point of difference and competitive advantage.

We've created the following infographic to help you get started on assessing the value of a potential purchase opportunity.

It’s based on some of the key aspects we look at when assessing business value for our clients.

The JPAbusiness team has created a number of free resources to help our clients and subscribers understand the business valuation process:

- How to assess business value ebook

- Strategic value checklist

- How to calculate Business Maintainable Earnings infographic

- What is the difference between a valuation and a market appraisal? video

Take a look at our online Resource Library for more free resources for business operators, buyers and sellers.

If you would like advice or support regarding business valuation, please contact the JPAbusiness team for a confidential, initial discussion.