When advising clients looking to buy businesses, as well as running businesses, we use a number of different methodologies to assess value.

A business is a dynamic entity – a ‘going concern’ – so you can’t just value it at a point in time. You need to assess the level of cash flow it is generating today, and what you can expect it to generate into the future. You then need to assign a ‘present day value’ to those potential future cash flows.

One way we do this is by using the discounted cash flow (DCF) valuation method.

How does DCF work?

The DCF method takes the time value of money into account by considering the expected future cash flows of an investment and discounting them back to today’s value through use of a discount rate.

The expected future cash flows are what the company expects to pay to its shareholders and the discount rate is the measure of risk associated with the specific business.

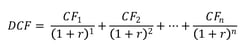

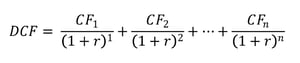

The formula used to calculate the DCF is as follows:

Where:

- ‘n’ is the expected life of the investment

- ‘CF’ is the expected cashflow ‘x’ years into the future

- ‘r’ is the discount rate.

When calculating the present value of an investment using the time value of money, we divide the investment by one plus the discount rate, to account for potential opportunities forgone to undertake the investment.

However, we then must raise it to a power, to offset the compounding effect (interest generated on interest) for each year.

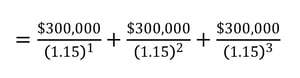

Consider the following example:

An engineering business is expected to generate free cash flows of $300,000 per annum for the next three years. The return expected from the investment is 15% per year.

For this scenario:

- the expected life of the investment, ‘n’, is three years

- the expected cashflow, ‘CF, is $300,000 per year

- the discount rate, ‘r’, is 15%.

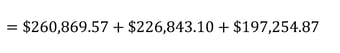

We then put this information into the DCF formula as follows:

As a result, today’s value of the engineering business’ forecast cash flows is estimated to be ~$685,000.

Of course, this is the estimated value of those cash flows to the owner who is operating the business. To assess what the business might be worth to another business investor, we need to consider the market appetite for taking a risk on such an investment. This is where your business valuer’s experience and judgement plays a role.

Cash earnings key to business value

DCF is only one way of assessing value, but it is something we consider when valuing a business.

Ultimately the value of a business – apart from value of the assets – has a lot to do with the cash generated by the business, the quality of those cash earnings, and the risks and issues over the forward period that might adversely and positively impact those cash flows.

JPAbusiness doesn’t necessarily advocate DCF as a valuation methodology for all businesses, nor is it a silver bullet when considering the potential return on a business investment. It can appear a bit technical and confusing, however it is a very useful concept for business owners and those looking to acquire a business, as it helps to tease out the dynamics and elements that contribute to cash earnings in the forward period – a key aspect in terms of likely ongoing performance.

If you would like support to understand the forward cash flow of a business we would be pleased to assist. Contact the team at JPAbusiness on 02 6360 0360 (Orange) or 02 9893 1803 (Parramatta) for a confidential, obligation-free discussion.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.