When buying a business, the due diligence process involves checking and verifying information relating to the basic operations and performance of the business you're interested in.

Due diligence is about identifying risks, issues and any material differences between what has been represented in information provided previously on the business, and what you and your advisor identify in the due diligence process.

If you know the risks before you jump (buy the business), then you can plan your landing (mitigate and manage the impact) during the business transfer.

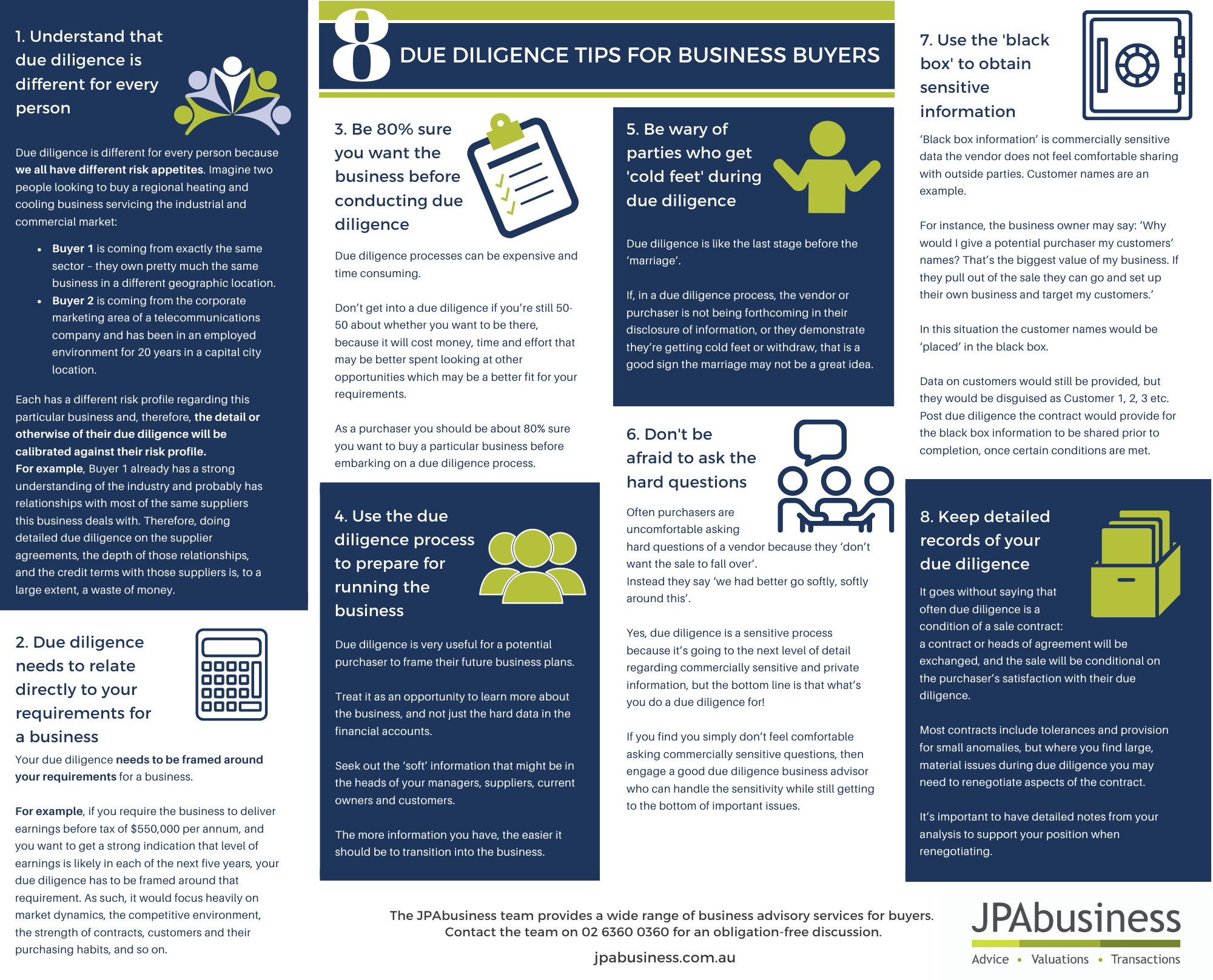

Over the years we have seen the best and worst of how people go about buying and selling businesses. The cheat sheet below sums up some of our top tips for conducting due diligence.

Click on the image to open the easy-to-read pdf version.

Custom due diligence checklists

The JPAbusiness team regularly prepares custom Due Diligence Checklists for business purchase clients, tailoring these documents to ensure robust information collection for each potential business purchase.

We have also created a free Due Diligence Checklist for our readers.

If you would like advice about conducting due diligence on a business purchase opportunity, contact the team on 02 6360 0360 or 02 9893 1803 for a confidential, obligation-free discussion.