We provide a range of services to business buying clients, from initial review and feasibility, through to business valuations, a preliminary assessment of the strength of the opportunity, full due diligence services if the party has lodged a non-binding offer and is seriously interested in the business, through to merger and acquisition facilitation services.

We have helped some clients find the right business within six months while, for other clients, it has taken over three years.

The key phrase is ‘the right business’; I’m sure we could speed up the process if our aim was just to help our clients buy ‘a’ business, but that’s not our job.

Don’t rush

Emotion can play a big role in buying businesses, probably more so than when selling. Because of emotion there is a risk people will identify an opportunity and rush, rush, rush, because they fear if they don’t, they will miss out.

I always say two words to clients who are looking to buy a business: “Be patient.”

Businesses are not highly liquid assets. If you make a hasty decision, with limited information, and purchase the wrong business, you can’t easily extricate yourself.

But do have passion for the opportunity

Having warned against being too swayed by your emotions, I want to emphasise that buying a business should not be emotion-less. A business is a long-term investment so having passion for the business opportunity is critical.

I tell my clients: “Before you think too much about the price, can you envisage yourself in this business long-term? Are you passionate about what it delivers? Is this business aligned with your core skills and interests and/or your existing business assets and objectives?”

If you can’t answer ‘yes’ to those questions then, regardless of what you pay, the business will be high risk. Your passion and emotional reaction just need to be balanced by objective data and, ideally, independent advice.

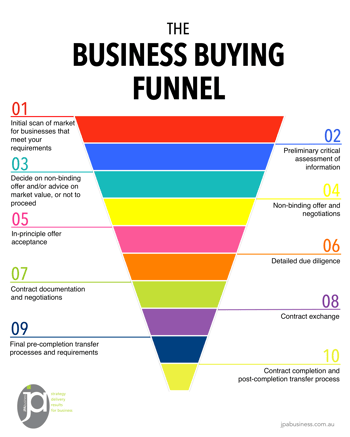

Use the Business Buying Funnel

A key tool for assessing a business and determining whether it’s right or wrong for you is what I call the funnel process.

[We have created the 10-step Business Buying Funnel to help readers understand and apply this process. Click on the link or image for a full explanation.]

Imagine the top of the funnel is wide and has a screen which sifts out businesses which don’t meet your requirements.

These requirements may relate to:

- Geography

- Size and turnover

- Earnings

- Price

- Product or service

- Customer base, etc.

Once the various sale opportunities have been ‘sifted’ you are left with the select few businesses which meet your requirements.

The funnel process allows you to do some initial testing and assessment upfront, against your clear objectives, and determine quickly whether the stars will line up or not.

Beware the reticent seller

If you can’t get basic, solid information on the business upfront there is probably good reason the seller is holding back. Be prepared to cut and run, and focus on other opportunities.

So, how long does it take?

Buying a business should take as long as it needs to take for you to find the right business.

Be prepared to invest in independent advice from an advisory, valuation or accounting business, to pressure test your views, support your decision making and balance your important emotional reaction with objective data.

Resources to help you manage the purchase process

We have produced a number of free resources to help our clients and subscribers when buying a business:

- Buying a small to medium-sized business eBook

- How to conduct due diligence on a business purchase eBook

- Business Buyer’s Checklist

- Buying a Franchise Planning Sheet

- Buying a Business Planning Sheet

- Due Diligence Checklist

You can download these and other free resources from our online Resource Library.

JPAbusiness offers a range of business valuation, advisory and transaction services. For more information about any of our services, contact the team on 02 6360 0360 for a confidential discussion.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.