The JPAbusiness team has been involved in setting up and facilitating a number of successful joint ventures over the years, and we have also been called upon to sort out arrangements where things have gone wrong or haven’t been set up with adequate planning and foresight. Preparation is key!

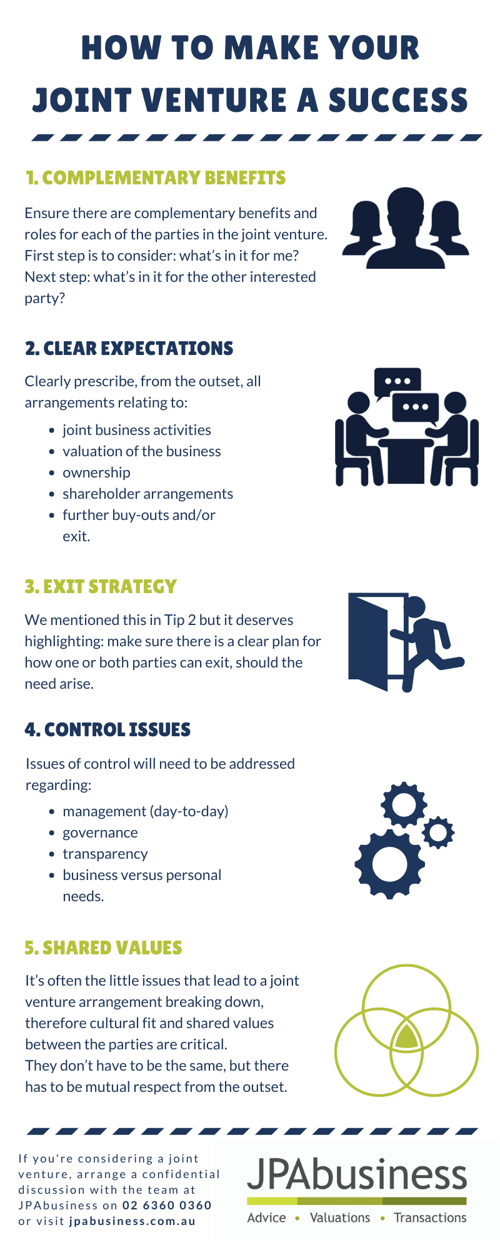

If you are considering entering into a joint venture, we have created the following infographic to help you.

The infographic lists five issues to be aware of and which should be raised with all parties early in the planning and negotiation stages.

What is a joint venture?

There are generally two broad types:

- Business benefits – Joint ventures that focus on joint business activities and leverage each other's scale and expertise (complementary benefits) to drive mutual growth and synergies.

- Business benefits and ownership – This type of joint venture combines the features above with a shared ownership (equity) position and potential for top-up or further buy-out of equity, usually through the issue of options and an agreed valuation, etc. This arrangement provides the synergy benefits for the party or parties, investment of additional capital and an incremental return on risk capital based on the growth in the business.

Do you need help planning a joint venture?

Joint ventures can provide a great vehicle for business and personal success – they just need to be well planned from the outset.

If you need help planning or negotiating a joint venture, JPAbusiness provides a number of related services, including:

- Independent business valuation

- Negotiation facilitation between joint venture parties

- Commercial joint venture agreement drafting and advice

- Shareholder agreement drafting and advice.

We have also created free online resources on the topic which may assist you:

- 'Shareholders' agreement' checklist

- 'How to bring a new shareholder into your business' cheat sheet.

To learn more about how we can help, contact the team at JPAbusiness for a confidential, obligation-free discussion.