In helping clients find and acquire businesses, we’ve found that preconceptions, assumptions and emotions can significantly increase the risk that the purchase will not meet expectations and value projections.

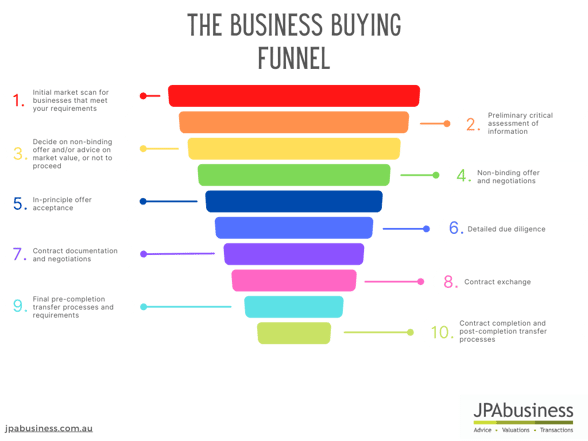

Our 10-step business buying process has been created to mitigate these issues. It is drawn from several decades’ experience and learnings, and is designed to help you make an objective assessment of whether a potential acquisition is a solid match with your requirements.

Step 1: Imagine the process of assessing different businesses for sale as a funnel

The top of the funnel is wide and has a screen which sifts out businesses which don’t meet your requirements.

These requirements may relate to:

- Geography

- Size and turnover

- Earnings

- Price

- Product or service

- Customer base, etc.

Once the various sale opportunities have been ‘sifted’ you are left with the select few businesses which meet your requirements.

Step 2: Conduct initial due diligence

This is a preliminary critical assessment of the information available on the business opportunities.

The information you need to assess is:

- Does this business have a positive earnings performance?

- Are earnings on an upward trend or a downward trend?

- Is there a point of difference in the business that goes to achieving business maintainable earnings?

As you uncover more information, ask yourself:

- Would I be passionate about and feel confident in operating this business?

- Is there a close alignment between my skills and this business?

- Is there value in purchasing this business versus starting a similar business myself?

Based on this high-level information assessment, select the business which appears to meet your requirements.

Step 3: Ask yourself: ‘Based on the information I have, do I feel confident to put in a non-binding offer on this business, or are there gaps in the information I have received which makes it difficult to assess the real value of the business?'

If you feel confident, put in a non-binding offer – this will test the expectations of the vendor. If you put this in writing it will emphasise your credibility and serious intent to the business owner.

If you’re not confident, you may need to seek additional advice, such as an independent valuation or market appraisal on the business.

Step 4: If you opted for a market valuation in Step 3 and the result supported your initial interest and/or provided further evidence that the opportunity has a good chance of meeting your requirements, make a non-binding offer

You don’t want to embark on a costly due diligence process before knowing that you and the vendor are aligned regarding price.

A non-binding offer allows you to weed out businesses that don’t match your requirements on price and, as it’s subject to due diligence, you can confirm all the important details later, when you’re further down the funnel.

Step 5: In-principle offer acceptance and heads of agreement

If you put forward a non-binding offer, the vendor may come back and say something like ‘I would accept that, but only on the basis of X and Y’ or ‘I would not accept that, but I’d accept this’.

Then there’s a brief period of negotiation – still in a non-binding sense – about a price and key terms.

This negotiation should culminate in a heads of agreement, or a term sheet, which is a commercial document that principally gets everyone on the same page.

In simplified terms it will say:

Party A has agreed to pay Vendor B X dollars for the business.

Party A and Vendor B have agreed on the following terms of sale.

This potential transaction is subject to a period of detailed due diligence by Party A.

To facilitate this, Vendor B agrees to a period of X number of days of exclusivity for Party A to conduct their due diligence.

In this context, ‘exclusivity’ means that Vendor B will not solicit or deal with any other parties for the stated period of time because they know Party A has put forward an offer and terms that, in principal, they are happy with. Vendor B knows that Party A intends to invest money and time to conduct due diligence, and has genuine intent to purchase the business, subject to this due diligence.

Step 6: Conduct a thorough due diligence utilising the support of your advisors

Seek advice from a business advisor, an accountant or a solicitor (or all three) who is/are familiar with corporate and business enterprises to help you investigate the core due diligence requirements.

Robust due diligence process should cover three core areas:

- Financial

- Commercial

- Legal

See our free JPAbusiness Due Diligence Checklist for more information about this critical step.

Step 7: Contract documentation and negotiations

A good broker will provide the solicitor with a detailed list of key commercial terms that have been worked through and the heads of agreement, so the solicitor can draft the business sale agreement.

This is not a job for a lawyer who simply knows about residential or commercial property conveyancing. Having a lawyer with experience in business sales is critical.

Step 8: Contract exchange

Exchange of contract is where a legal contract – a business sale agreement – is exchanged between the parties and a deposit is paid on the sale price.

That deposit is held, but the sale doesn’t complete, until various ‘condition precedents’ occur.

Step 9: Final pre-completion transfer processes and requirements

Often, as the business sale agreement is drafted in parallel to the due diligence process, it will provide for certain conditions – what’s called ‘condition precedents’ – which occur post-exchange.

One of those condition precedents may be related to the sharing of ‘black box information’ between exchange and completion.

Black box information is usually commercially sensitive and relates to pricing, customers, terms of existing contracts and so on.

The condition precedent may say: ‘This information has to be shared prior to completion and the purchaser reserves the right to confirm their position based on reviewing the final black box information.’

Step 10: Contract completion and post-completion transfer processes

Ensure you have a transition checklist prepared and work through rigorously to address each of the pre and post-completion issues and conditions.

If you would like advice or support to assess a business acquisition opportunity, contact the team at JPAbusiness on 02 6360 0360 or 02 9893 1803 for a confidential, obligation-free discussion.