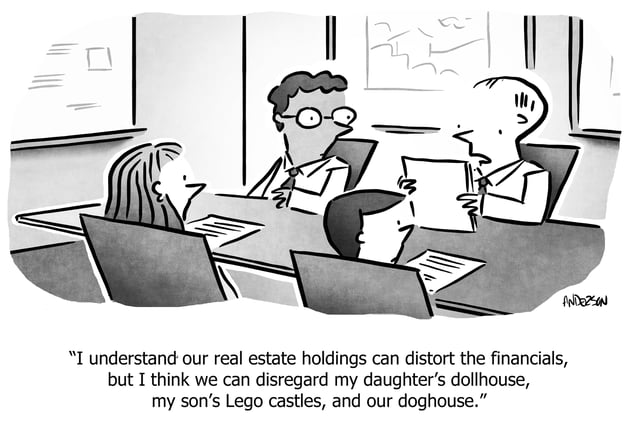

Businesses – particularly family businesses – often use real estate assets as part of their wealth generation strategy.

This may lead to situations where the business and real estate assets are interdependent, creating complexities when it comes time to exit and establish a fair market valuation.

For example:

- A business may be sold with the intention of paying off a real estate loan. Whatever the vendor’s requirements, however, the loan value should not affect the value of the business.

- A business which operates from its own premises may charge the business rent above or below market rate. This can distort the financial results of the underlying business.

When looking to buy or sell a business, make sure you have an experienced business advisor who can ensure the effects of real estate ownership are reflected in the sale terms and conditions negotiated.

We have created a number of free resources to help our clients and subscribers when buying businesses:

- Buying a Business Planning Sheet

- Due Diligence Checklist

- Buying a Franchise Planning Sheet

- How to conduct due diligence on a business purchase eBook

- Business Buyer's Checklist

You can find more resources for buying, selling and managing businesses in our online Resource Library.

If you would like advice or support regarding any aspect of buying or selling a business, contact the JPAbusiness team on 02 6360 0360 for a confidential, initial discussion.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.