At JPAbusiness we know that professional, credible information is key to a successful business sale.

When preparing an Information Memorandum, or Business Profile, on your business, put yourself in the shoes of a potential buyer. What would you need to know before making a decision about such a significant investment?

We created the JPAbusiness IM/Business Profile Checklist to help you answer that question.

What happens when you don’t provide good information

I have seen many deals fall over through either lack of information, or information which doesn't have integrity.

In one case, when I was working for a purchaser, we asked for a business’s current year client sales and financial performance information. The figures we were given changed materially, four times, over a couple of months and this really knocked the buyer’s confidence in the whole process.

Now those figures may have changed for legitimate reasons, and in such a case it would be best practice for a seller to communicate those reasons in a timely, open and transparent manner.

This didn’t happen for us.

Here’s an example of how to do it right:

You provide a sales forecast to a potential buyer, but suddenly external issues cause a couple of contracts to be terminated, overnight. You now have a hole of $500,000 in your forward sales.

You call up the buyer, or their advisor, and say: “Look, we provided you our sales forecasts in good faith, but due to ‘X’, they're no longer correct. As a result, we’ll now be doing ‘Y’ within the business to address this issue and cover this gap.”

That shows management is on top of the issue, and it shows the business is resilient and can manage through a tight situation.

When a seller doesn’t communicate clearly and in a timely manner, or provides contradictory information, it puts a handbrake on purchasers. They start thinking ‘these people are lying to me’, or ‘oh my gosh, they can’t run a business’.

Either way it’s bad news for the seller.

If the buyer decides to go ahead with the deal, they will downgrade their offer to account for the increased risk associated with poor management and poor record keeping, or they will walk away entirely.

I’ve seen both outcomes.

How to provide detailed, credible information

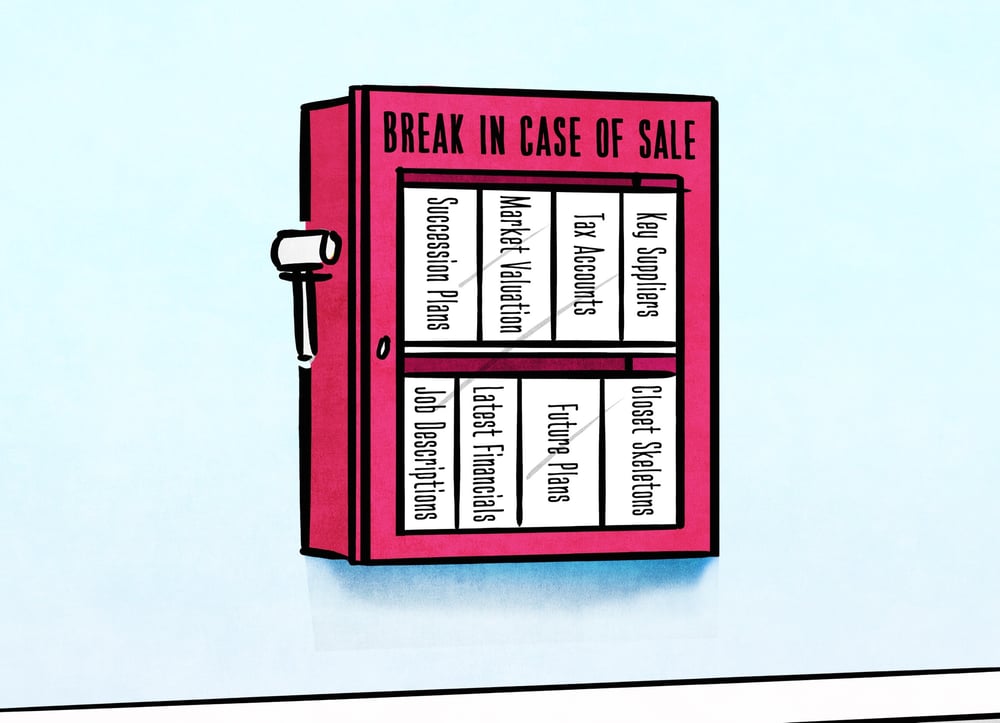

When selling a business it’s important to provide information – financial and non-financial – that covers the length and breadth of exactly what the business does, how it does it, and how it has performed in the past.

Sometimes sellers are nervous about providing this information because of the commercial sensitivities of operating in a competitive environment. That caution is justified, but there are ways to protect confidentiality and that’s where the advice and support of a good advisor comes into play.

Experienced advisors have ways of prequalifying genuine potential purchasers, and providing robust information on your sale opportunity, including information about clients, suppliers and other key commercial aspects, without necessarily identifying parties or breaching commercial sensitivities.

How a professional valuation can help

At JPAbusiness our policy is that we won’t be engaged to facilitate a sale of a business for a client until we have first conducted an independent market appraisal or business valuation.

The valuation process involves us looking at the business as if we were a purchaser. We request and scrutinise financial and non-financial information, and we ask all the questions a potential buyer would want answered.

This means that when the time comes to put the business on the market, all this important information has already been gathered by the seller, checked, cross-checked and verified by our team, and is ready to be presented to potential buyers in a professional manner.

If you would like support or advice about any aspect of selling a business, contact the team at JPAbusiness on 02 6360 0360 or 02 9893 1803 for a confidential, obligation-free discussion.