ABOVE: James presenting the findings of the Family Business Dynamics research paper.

ABOVE: James presenting the findings of the Family Business Dynamics research paper.

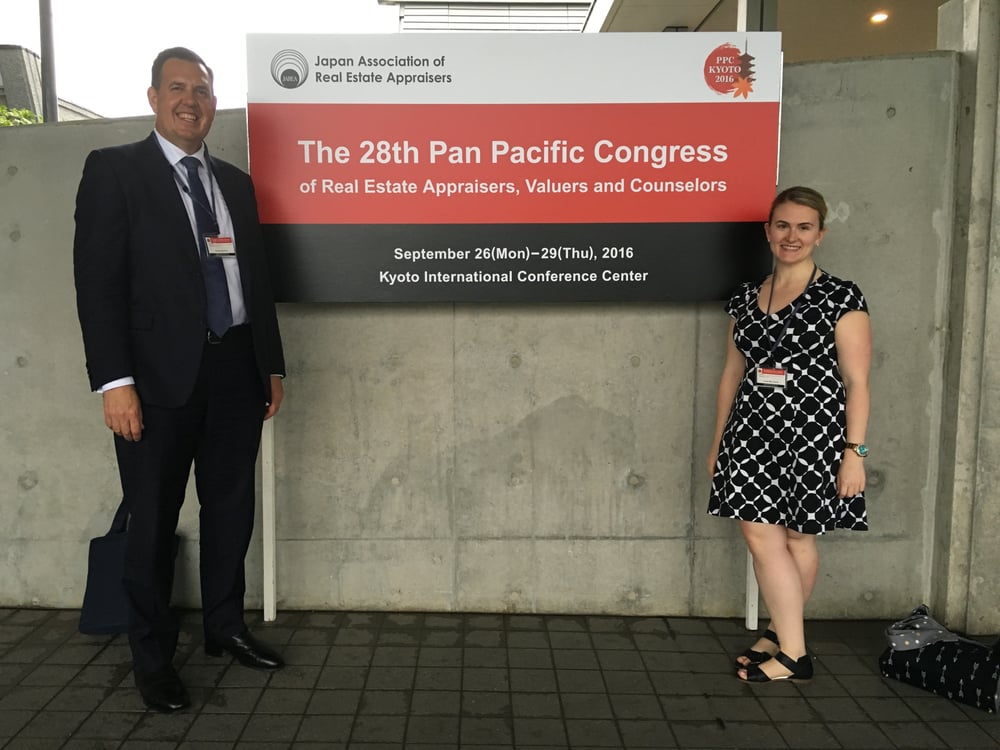

Last week I attended the 28th Pan Pacific Congress of Real Estate Appraisers, Valuers and Counselors in Kyoto, Japan.

There were over 750 delegates from 14 Asia-Pacific countries (from USA and Korea, to Japan and Mexico) there to hear the latest developments in valuation practice relating to real estate, property and business assets.

JPAbusiness business analyst Louise Carroll and I presented a research paper on Family Business Dynamics and the Significant Impacts on Business and Related Asset Valuations.

The conference was held at the same venue in which the Kyoto Climate Change Protocol was inked, in Japan’s historic city of Kyoto, once the empire’s ruling capital.

ABOVE: James and Louise at the Pan Pacific Congress in Kyoto, Japan.

ABOVE: James and Louise at the Pan Pacific Congress in Kyoto, Japan.

One guest speaker at the conference was Ando Tadao, a renowned and celebrated self-taught Japanese architect.

In his key-note speech, the following comment resonated with me when thinking about business and valuation: “Have you ever had events that moved your heart? Without heart – just making money – it’s not good at all!”

Architecture is a lot like valuation; it’s both an art and a science.

The essence of good business valuation is to forecast or predict the emotional response to a particular business asset from a specified market.

For sure, as certified practising valuers we take great pride and put in great effort (and our expertise) to objectively quantify the basis of our valuation estimates, which are often about risk and market assessment and also facts, figures and performance.

Ultimately, though, a useful valuation is able to ‘rationalise’ market dynamics and appetite towards a particular asset, and such an assessment can be more about market psychology than mathematics!

It’s a litmus test of the underlying potential unmet needs in the market, and how the ‘feelings of the heart’ might interact with the essence of the business assets being evaluated.

As Scott Robinson, the US-based president of the Appraisal Institute, said at Kyoto: “[A valuer’s role] is recognising things that others can’t see in the market you are in.”

If you are in the position of seeking advice and support to assist with important and difficult family and business transition and exit decisions, getting a robust business valuation can make a world of difference.

As Tadao pronounced in Kyoto: “Life is full of wonder; you never know what happens. If you just move forward some luck will come.”

From my experience, luck usually comes after you’ve done your preparation and homework!

Moving forward with a business transaction, sale process or transition event is always challenging. My advice is to make sure you prepare thoroughly and seek the right support to ensure luck will come your way.

If you need some business valuation advice to help determine your business succession, exit or transition path, contact the team at JPAbusiness for a confidential, no-obligation discussion.

ABOVE: Kinkakuji (the Golden Pavilion) is one of Kyoto’s most famous buildings. It dates back to 1397 and is a World Cultural Heritage Listed site. The top two levels of the building are clad with gold leaf, while the garden provides a setting of tranquility and peace: value and heart!

ABOVE: Kinkakuji (the Golden Pavilion) is one of Kyoto’s most famous buildings. It dates back to 1397 and is a World Cultural Heritage Listed site. The top two levels of the building are clad with gold leaf, while the garden provides a setting of tranquility and peace: value and heart!

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.

James Price has over 30 years' experience in providing strategic, commercial and financial advice to Australian and international business clients. James' blogs provide business advice for aspiring and current small to mid-sized business owners, operators and managers.