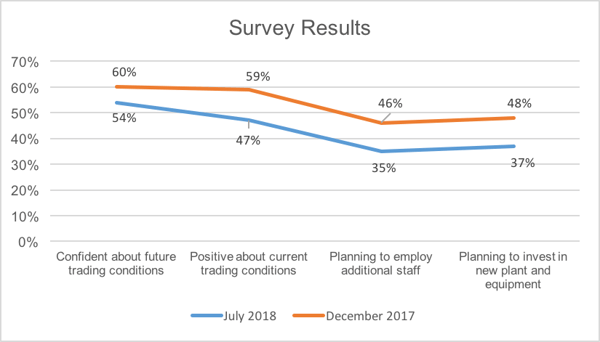

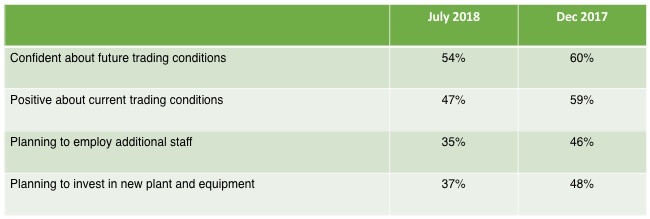

Almost 54% of respondents to our July survey indicated they were ‘confident’ about trading conditions heading into the 2018/19 financial year, while 47% indicated current trading conditions were ‘positive’.

The results indicate a softening in business confidence among respondents since our first survey in December 2017, when the results were 60% and 59%, respectively, for those two questions.

The results also appear to be in line with the NAB business confidence index, which dropped from a high of 12 in January to an 18-month low of 6 in June, before edging up to 7 in July.

Figure 1. Comparison of JPAbusiness Business Confidence and Outlook Survey results – July 2018 and December 2017

In this blog we’ll share our survey results, offer advice to help business owners take advantage of opportunities and overcome challenges identified in the survey, and make some predictions about the outlook for Australian business going forward.

Survey results disclaimer

The JPAbusiness Business Confidence and Outlook Survey was not designed as a ‘scientific survey’, as our respondents elected to take part and were not chosen at random.

JPAbusiness does not recommend readers take any action based on the outcome of this survey. Instead, readers should make their own inquiries and seek independent, professional advice before taking action or relying on information in this blog.

Results snapshot

This section includes a snapshot of key findings from the survey and a comparison of results from the December 2017 and July 2018 surveys.

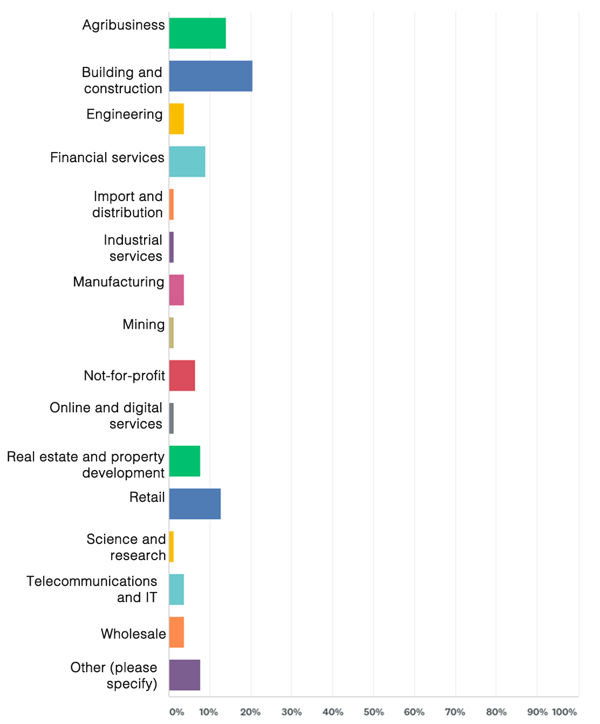

Range of industries represented

The second JPAbusiness Business Confidence and Outlook Survey was held in July 2018 and attracted 80 responses from a range of industries.

The most highly represented industry was building and construction, followed by agribusiness, retail and financial services.

Figure 2. Results of survey question 1: What industry do you operate in?

There was a good spread of business sizes, with turnover ranging from $100,000–$500,000 up to $50,000,001-plus.

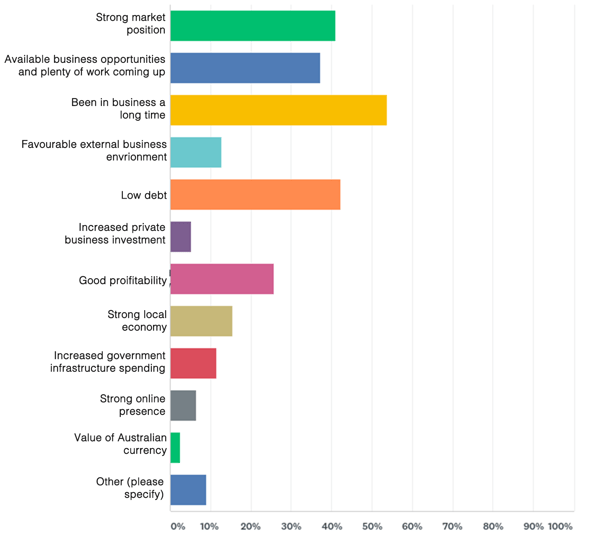

Positive and negative impacts on business

We asked respondents what issues were positively and negatively impacting their business performance; below are the most popular responses.

Top issues positively impacting business performance:

- 54% – ‘Been in business a long time’

- 42% – ‘Low debt’

- 41% – ‘Strong market position'

Figure 3. Results of survey question 3: What are the issues positively impacting your business performance?

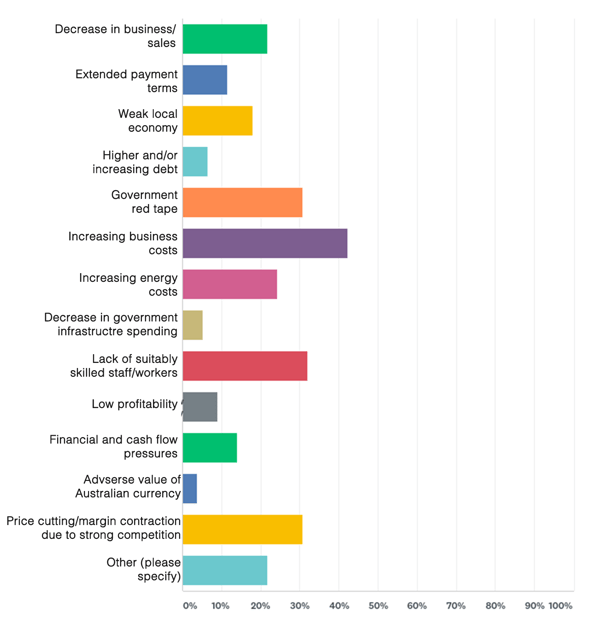

Top issues negatively impacting business performance:

- 42% – ‘Increasing business costs’

- 32% – ‘Lack of suitably skilled staff/workers’

- 31% – ‘Price cutting/margin contraction due to strong competition’ and ‘Government red tape’

Figure 4. Results of survey question 4: What are the issues negatively impacting your business performance?

Business trading conditions and confidence for the future

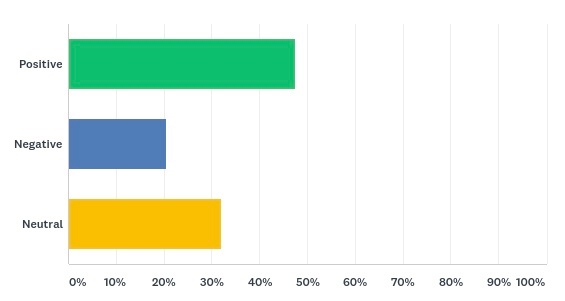

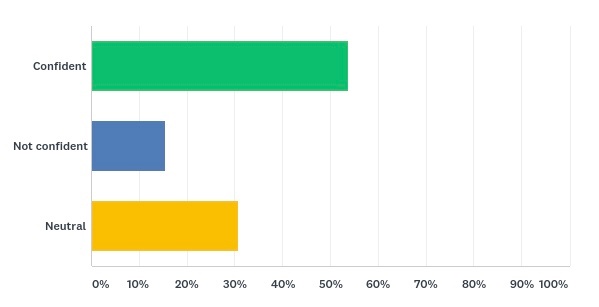

Almost half the survey respondents were ‘positive’ about current trading conditions in their industry (Figure 5), with this confidence also reflected in their outlook for trading conditions in FY2018/19 (Figure 6).

Figure 5. Results of survey question 2: How would you categorise current trading conditions in your industry?

Figure 6. Results of survey question 5: Looking forward, what is your level of confidence about trading conditions this financial year (2018/19)?

However, when compared to the trading conditions identified in our December 2017 survey, overall business confidence levels have dropped. This also appears to have had a direct impact on businesses’ willingness to invest in additional staff, plant and equipment.

Table 1. Comparison of JPAbusiness Business Confidence and Outlook Survey results – July 2018 and December 2017

Table 1. Comparison of JPAbusiness Business Confidence and Outlook Survey results – July 2018 and December 2017

Positive business owners planning to invest

On a more upbeat note, a significant proportion of the respondents who were positive about trading conditions in 2018/19 appear to be planning to employ additional staff in anticipation of further growth.

Moreover, most businesses planning to employ additional staff in the year ahead are also planning to invest in plant and equipment.

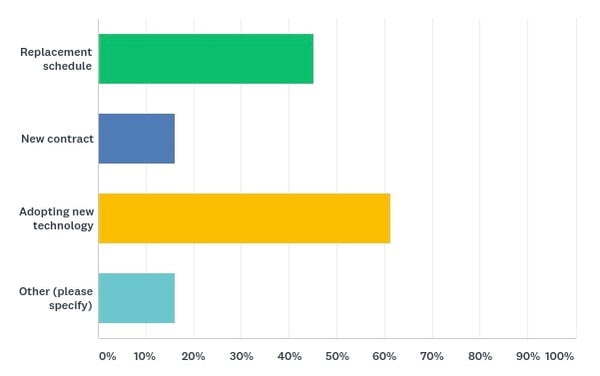

Survey results indicated the plant and equipment spend is mostly for adopting new technology (61%) and/or part of a regular asset replacement schedule (45%).

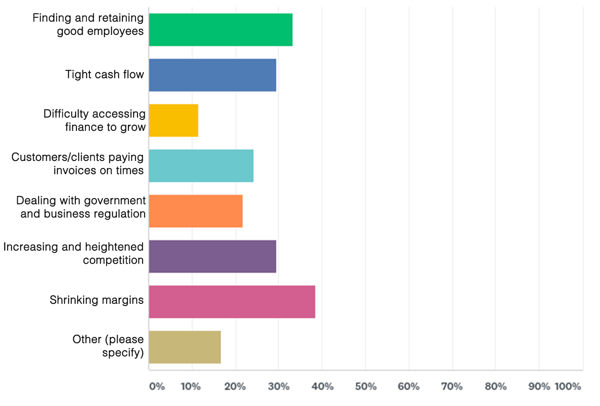

Biggest challenges for business owners and managers

A new question in the July 2018 survey was: Looking back over the past six months, what were the biggest challenges that impacted your business?

It was interesting to note that the answers were equally spread across a range of factors, including staff, margins, competition and cash flow.

Figure 7. Results of survey question 12: Looking back over the past six months, what were the biggest challenges that impacted your business?

Moderate outlook for employment

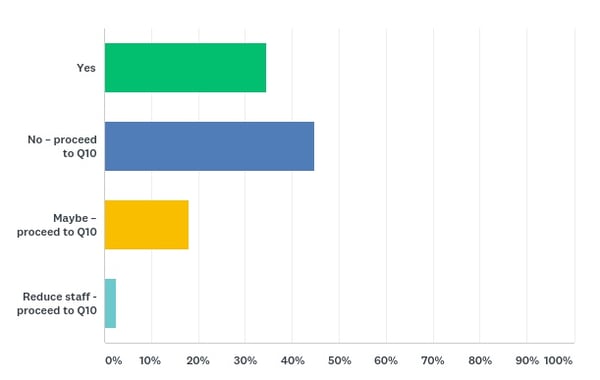

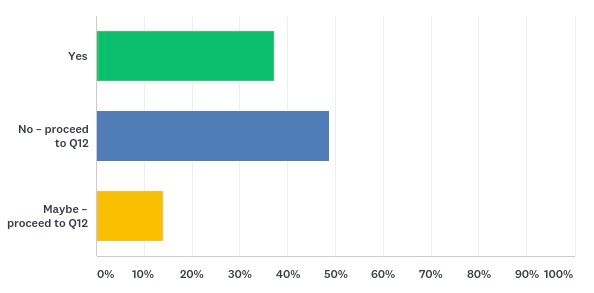

About 35% of survey respondents indicated their intention to employ additional staff in FY2018/19, while close to 45% were not intending to take on more employees.

Figure 8. Results of survey question 6: Do you plan to invest in employing additional staff this financial year (2018/19)?

Figure 8. Results of survey question 6: Do you plan to invest in employing additional staff this financial year (2018/19)?

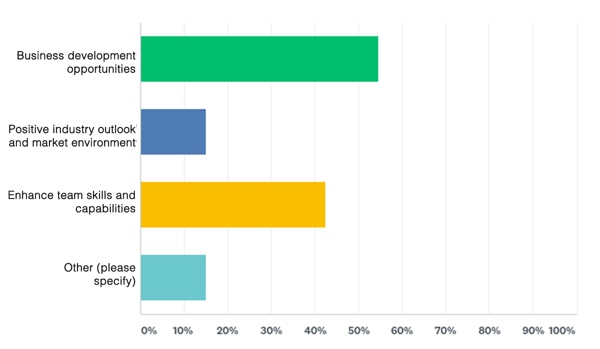

The top reasons for employing new staff were:

- Business development opportunities

- Enhancing team skills and capabilities

- Taking advantage of a positive industry outlook and market environment.

Among those who indicated they would employ additional staff as a result of ‘business development opportunities’, the two most highly represented industries were building and construction, and financial services.

Increased employment in these sectors is likely to have a flow-on effect of increasing activity in the economy.

Figure 9. Results of survey question 9: What are your reasons for employing extra staff this financial year (2018/19)?

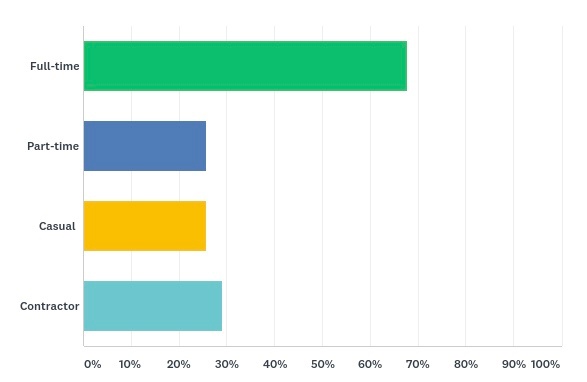

Of those planning to employ additional staff, respondents indicated almost 68% of these new staff would be employed on a full-time basis.

Figure 10. Results of survey question 7: On what basis will those additional staff be employed?

Figure 10. Results of survey question 7: On what basis will those additional staff be employed?

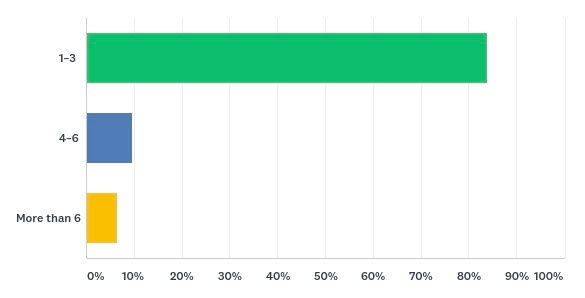

Of the respondents planning to invest in additional staffing levels, the vast majority (84%) were planning to increase staffing levels by a small number (1–3).

Figure 11. Results of survey question 8: How many additional staff do you plan to employ this financial year (2018/19)?

Investment in plant and equipment planned

Around 37% of respondents indicated an intention to invest in new P&E in FY2018/19, with most of these investments driven by the need to adopt to new technology (61%) and meet replacement schedules (45%). Just over 16% indicated the planned investment was due to new contracts.

Figure 12. Results of survey question 10: Do you plan to invest in new plant and equipment this financial year (2018/19)?

Figure 12. Results of survey question 10: Do you plan to invest in new plant and equipment this financial year (2018/19)?

Figure 13. Results of survey question 11: What are your reasons for investing in new plant and equipment this financial year (2018/19)?

Figure 13. Results of survey question 11: What are your reasons for investing in new plant and equipment this financial year (2018/19)?

Increasing business costs and stronger business competition is likely to have played a major role in deterring other respondents (49%) from planning to invest in P&E in FY2018/19.

Tips for seeking finance for P&E investment

If you’re a business owner or manager looking to invest in P&E, you may need to seek finance from a bank or other lending institution.

It’s important that your financier understands the ‘investment story and rationale’, as this will smooth the path to getting the new plant and technology in your business in a timely manner and seeing the benefits flow.

As we discussed in our free eBook, Managing your banking relationship, there are many things you as a business owner and manager can do to influence a bank’s appetite for lending to you.

Our tips for making the most of opportunities

Below are the top 3 positive issues impacting business performance, as identified by our survey respondents:

- Been in business a long time

- Strong market position

- Low debt.

We’ve created the following tips to help you make the most of opportunities presented by these positive issues.

1. Long-term presence

More than 50% of respondents indicated longevity in business was a key to their positive performance.

There is often a correlation between businesses operating over a long period of time and strong performance, due to their established client base and strong customer relationships.

You can’t change the age of your business, but there are many things you can do to boost performance. Take a look at our online Resource Library for a range of free eBooks and other resources dedicated to improving business performance, including:

- Managing cash flow and working capital

- Managing staff for high performance

- Business planning for small to mid-sized enterprises

- Succession planning – How to future proof your business

2. Strong market positioning

Over 40% of respondents cited strong market positioning as a key element of positive business performance.

Understanding and leveraging your business’ point of difference is a critical component of maintaining a strong market position. Take a look at our blog on the ride-sharing services Uber and Lyft, for an illustration of the value of point of difference.

Tips to maintain a strong market position:

- Continuously innovate to maintain a competitive edge

- Ensure your business offering demonstrates value aligned to client needs

- Differentiate through type, level of service, extent of product range etc.

JPAbusiness’ often works with clients on their strategic direction and competitive market position. This may involve focusing on organic (i.e. in-the-business) growth strategies, such as more targeted strategies to penetrate market segments with specific and relevant offerings.

In other cases it may involve focusing on inorganic growth, such as business acquisitions to enhance capability or market position, and/or extension of product offers through dealership and distribution agreements etc.

3. Low debt

Over 40% of respondents cited maintaining a low debt as one of the key elements for their positive business performance.

One of the key focus areas for business owners to drive their business forward is maintaining an awareness of their capital base and liquidity for working capital and investment purposes. Critical to this is maintaining a strong cash flow.

Cash flow is important whether you choose to fund your business’ working capital needs with cash or a line of credit. In the case of seeking credit from a bank, maintaining a healthy cash surplus will positively influence the bank’s view of your loan’s serviceability, which may result in less onerous loan conditions and covenants, more flexible financing options and improved cost of borrowing.

Take a look at our eBooks on Managing your banking relationship and Managing cash flow and working capital for more advice in this area. You can also download our free Working Capital Checklist.

Below are some tips from the eBooks mentioned above.

Tips to maintain/reduce business debt:

- Communicate regularly and proactively with your bank and provide them with evidence you are attuned to identifying and managing key business risks, reporting and governance processes.

- Ask the hard questions of new customers regarding payment history. Consider tightening payment terms until they’ve established a positive track record. Use credit rating agencies.

- Unless you’re a bank, don’t act like one. Some businesses have payment terms that state ‘the payment period is X days – if the account is not paid in X days the customer will be charged interest at a daily rate of Y per cent’. Interest being charged doesn’t necessarily help your cash flow!

- Record your inventory. Review it at least once a month to appreciate whether it’s over or under-valued versus your business needs.

Our tips for overcoming key challenges

Below are the top 3 negative issues impacting business performance, as identified by our survey respondents:

- Increasing business costs

- Lack of suitably skilled staff/workers

- Price cutting/margin contraction due to strong competition.

We’ve created the following tips to help you overcome the challenges presented by these negative issues.

1. Increasing business costs

Over 40% of respondents said their business performance was negatively impacted by increasing business costs.

Tips to overcome increasing business costs:

Cost management is not a one-dimensional issue. From experience in working with business owners, successful businesses look at the overall picture and are constantly ‘tuning up the engine’.

Businesses could attempt to control costs by periodically reviewing pricing strategies, as small changes can have an impact on revenue and profit. Similarly, there is sometimes the opportunity to outsource services not core to the business in order to have them delivered more effectively and lower the business’ overhead costs.

A key to this approach is to think about cost and benefit. Ask the simple acid test question: what is the value added from your investment in each operating cost associated with the business?

It’s also advisable for businesses to establish yearly financial goals and plan to achieve them. We have a number of free eBooks and templates that can help with your business planning processes.

Companies can also consider benchmarking the business by comparing the costs of key financials like rent, utilities etc, to similar businesses in your industry to see if you appear to be paying too much in a relative sense. This can often be a useful starting point to drilling down further on the value question.

2. Lack of suitable staff

More than 32% of respondents indicated a lack of suitable staff was holding back their business performance.

When employees don’t perform effectively, productivity drops and costs increase.

This may be a result of unsuitable staff being either let go and replaced, or trained further – both options take time and generally involve the contribution of other staff members, which can negatively impact overall business productivity.

Tips to overcome lack of suitable staff:

- Before you advertise or interview, sit down – on your own or with your management team – and decide exactly what impact you want the new team member to have on your business. Document those desired outcomes, then create a checklist of skills, capabilities and expectations needed to achieve them.

- Make sure you conduct a robust sourcing process – conduct a ‘due diligence’ process on the people you’re inviting into your business. Share the job of interviewing and selecting candidates to aid objectivity.

- Once the new staff member arrives, give them every chance of success. This starts with clear communication of your expectations for the role and a well-defined onboarding process, followed by regular performance reviews and professional development opportunities.

We have a number of blogs and eBooks on hiring and managing staff that can help you with these tasks.

One blog suggests 4 ways to take the emotion out of recruiting, and ends with this key piece of advice: be a patient hirer!

3. Price cutting/margin contraction due to strong competition

Over 30% of respondents indicated their business performance dropped due to increased competition.

Tips to overcome margin contraction due to increased competition:

- Do not compromise on your premium pricing – Though it’s a common belief that customers make purchasing decisions based largely on cost, it is rarely the primary reason a person buys. Research on customer buying patterns indicates buyers tend to be wary of products/services that are priced too low, as it sends a negative message about product quality.

Be careful, even during increased competition, that you’re not carried along with the market to the lowest common denominator on price.

- Critical factor in a purchasing decision should be value, not price – Having the ability to create and sell value to your customers is likely to be the trait that would set you apart from the sea of competitors offering products/services at a cheaper price.

It is important to understand the unique standards and expectations of the product in order to create value for your customers.

- Defend and grow the customer base by enriching and communicating the value proposition – Depending on how the customers perceive the product offering, you should decide on either maintaining or enhancing the value proposition.

During times of intense competition, it is important to focus on and enhance the value proposition the business was initially built on, rather than modifying that value proposition.

For example, if your company’s value proposition is to provide premium products/services, ensure the quality of those products /services are enhanced to retain your customer base when there is intense competition, rather than reducing prices.

Positive outlook for growth in FY2018/19

Our survey findings indicated a drop in employment prospects and investment in plant and equipment planned for FY2018/19, compared to the outlook for the first six months of 2018. This may be due to a very strong year for jobs growth in FY2017/18.

However, the survey results still indicate business owners and managers are fairly optimistic about growth prospects over the next 12 months. Other pointers to growth include:

- JPAbusiness’ economic forecasts for Australia FY2018/19 – indicate increase in private consumption levels and moderate improvement in employment prospects

- May Federal Budget – anticipated GDP growth to accelerate from current rate of 2.75% to 3% in FY2018/19.

Key growth opportunities in the next 12 months may include:

- business investment

- government investment

- household consumption

- exports.

Key risks in the next 12 months may include:

- employment growth

- commodity prices

- local consumption

- terms of trade.

Plan to maximise value in the year ahead

A period of growth can fray resources, negatively impact working capital and cash flow, and put other stresses and strains on a business’ ability to deliver its products and services to customers and clients.

If you’re looking to tap into growth opportunities in the year ahead, make sure your business’s ‘house is in order’. Take the opportunity to reflect, do some forward planning and seek advice to help ‘pressure test’ your plans and mitigate the downside risks in such an environment.

JPAbusiness offers a range of business advisory services to help place your business in the best position to take advantage of opportunities and minimise risks. Contact the team on 02 6360 0360 for an obligation-free, initial discussion.