Forecasts for the Australian economy in 2018 are cautiously optimistic, driven largely by improving global conditions but tempered by uncertainty around household consumption.

As reported in our Global Economic Outlook, the international economy appears to be improving and gaining momentum.

The ‘Advanced Economies’ group is experiencing cyclical recoveries, while the ‘Emerging Markets and Developing Economies’ group is benefiting from improving global demand and government spending.

What does this mean for Australia?

Stronger global activity, expectations of more robust demand, reduced deflationary pressures and optimistic financial markets are all upside developments in the international economy.

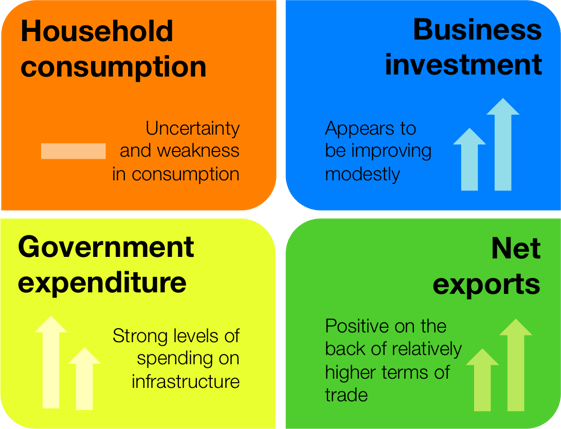

These factors have resulted in notable improvements in the Australian economy, which include:

- indicative increases in business investment

- increasing business confidence and conditions

- relatively higher terms of trade from higher commodity prices

- strengthening employment, anticipated to improve further.

Figure 1: Snapshot of the Australian economy (November 2017)

Opportunities for the economy

Australia has a diverse and strong commodity base and is heavily reliant on trade for its economic wellbeing.

The improving global outlook and demand for commodities supports Australia’s terms of trade and provides growth opportunities.

Stronger labour markets provide inflationary pressures, which supports wages growth and, consequently, household consumption.

Downside risks for the economy

Key downside risks centre around uncertainty and weakness in household consumption.

The following factors are restricting Australian household consumption growth:

- Weak wages growth – Low productivity growth, underutilisation of the workforce and technological changes are weighing down wages growth prospects.

Weak wages growth drags on household consumption (impacting business conditions for firms reliant on domestic consumption), inflation outcomes and expectations. - Financial instability – A decade of rising housing prices, low interest rates and easy credit has resulted in Australia carrying one of the highest household debt-to-GDP ratios in the world.

Sudden upward changes to interest rates, arising from global and domestic factors, could have adverse impacts on debt serviceability and economic growth.

High household debt also weighs down on household consumption.

Key economic indicator forecasts for 2018

Australian dollar

Our trading nation status means the Australian dollar invariably impacts the fortunes of a wide cross-section of business.

AUD forecasts by the major banks for the end of 2018:

- ANZ – 74 US cents

- NAB – 73 US cents

- CBA – 85 US cents

- WPC – 70 US cents

(The Australian dollar was worth 76.8 US cents on 7 November 2017.)

Some key factors to consider when assessing the AUD/USD exchange rate include:

- the outlook for global growth

- movements in Australian commodities prices

- the gap between US and Australian interest rates.

The main outlier (CBA) forecasts a higher AUD due to fiscal policy uncertainties under the Trump administration, despite a strong US economy and the US Federal Reserve lifting interest rates.

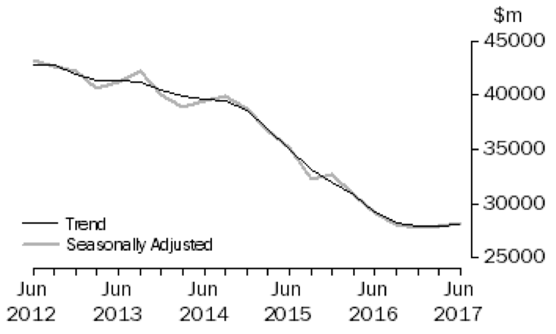

Figure 2: Graph of the AUD/USD exchange rate 2014–present

Source: WM/Reuters

Interest rates

Overnight cash rate forecasts for the end of 2018:

- ANZ – 2%

- NAB – 2%

- CBA – 1.75%

- WPC – 1.5%

(The overnight cash rate was 1.5% on 7 November 2017. The RBA has kept it at this level since July 2016.)

Why interest rates may rise

There are varying views on the direction of the overnight cash rate. The general consensus is a more ‘hawkish’ outlook on interest rates by the market i.e. they will increase in 2018.

This view is on based on:

- consecutive positive economic data

- upward revisions of GDP expectations

- downward revisions of unemployment expectations.

Why interest rates may remain steady

The following factors may affect the growth expectations of the Australian economy (a view taken by Westpac), and therefore an RBA decision to lift interest rates:

- current and possible continued lack of wage increase pressures, despite tighter labour market in Australia

- consumer caution

- slowdown of Chinese economy (in percentage terms), however still anticipated to achieve high growth.

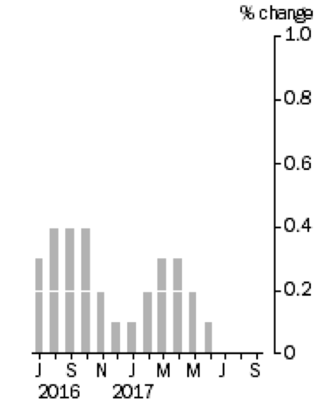

Business investment

Australian business investment appears to be picking up, albeit at a modest pace.

The drag from the decline in mining-related business investment appears to have bottomed out, and, going forward, may be supported by increasing commodity prices.

Business investment from manufacturing and other selected industries is also anticipated to rise.

Key drivers of business investment include:

- positive business conditions

- improving business confidence.

Key risks to business investment include:

- uncertainty around private consumption, particularly in the retail sector

- margin pressures from increasing business competition – exacerbated by globalisation.

We anticipate the recent strength in business conditions to continue, and have a positive outlook for 2018.

Figure 3: New business capital expenditure (capex) in Australia from mining, manufacturing and selected other industries on a quarterly basis

Source: ABS

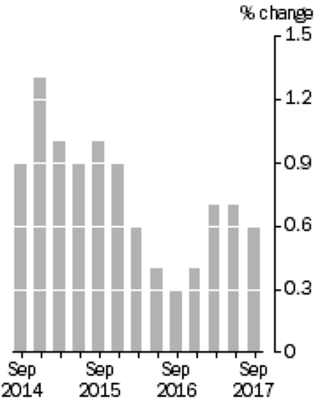

Household consumption

Household consumption is an area of uncertainty.

Retail trade, a proxy for household consumption, is cyclical, but the trend has been a decline from 1986 to the present.

The sector has been a particular area of weakness in the Australian economy since 2016, and the decline appears to be continuing.

Factors that have exacerbated this trend are digitisation (shift to online shopping and overseas competitors) and increasing competition and price pressures.

Contributors to low household consumption measured by retail trade include low wages growth and high household debt.

Figure 4: Retail trade – monthly turnover, current prices (seasonally and trend adjusted)

Source: ABS

Figure 5: Retail trade – quarterly turnover, in volume terms

Source: ABS

Household consumption is likely to be supported by a tighter labour market in 2018.

However, key risks to household consumption will remain, which include:

- low productivity

- low wages growth

- high consumer debt levels.

Wages

The Wage Price Index estimated an increase in wages of 1.9% through the year to the June quarter 2017. This represents a historically low level of wages growth.

Low wages growth has been a result of a combination of factors, including:

- adjustments following a decline in terms of trade

- increasing part-time and contracting arrangements of the labour force

- technological changes

- low inflation outcomes and expectations.

Wages are forecast to increase by 2.5% in 2018, on the back of improving labour market conditions.

However, the extent of the recovery may be affected by the level of underutilisation (measure of workers on a part-time basis who are seeking additional work hours) of the Australian workforce.

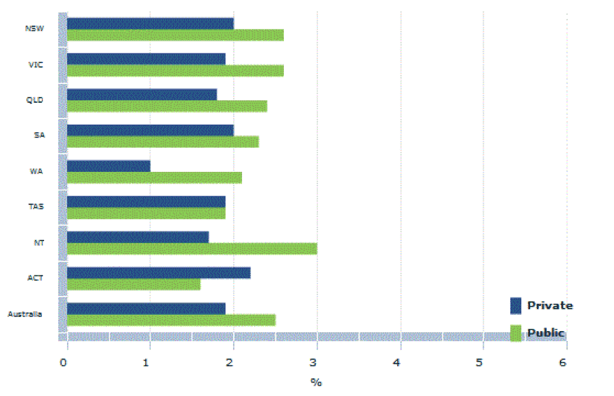

Figure 6: Annual change of total hourly rates of pay for year ended June 2017

Source: ABS

Employment

A common measure of the strength of the labour market is the unemployment rate.

The unemployment rate is currently around 5.5% – the lowest in four years. This rate represents a decrease of 0.2% over the year to the September 2017 quarter.

Some key drivers of strong employment growth include:

- recovering global economy

- relatively higher terms of trade

- improving business confidence and positive conditions.

JPAbusiness’ outlook for employment in 2018 is positive, as data indicates a recovering global and Australian economy and strengthening labour markets.

This will likely provide support and some further impetus for wages growth and inflationary pressures.

Inflation

In underlying terms, inflation is likely to remain low for some time, reflecting the slow growth in labour costs and increased competitive pressures, especially in retailing.

Inflation is likely to remain subdued, increasing at about 2% for the first half of 2018.

It is anticipated the rate of inflation may increase in the second half of 2018 due to:

- tightening labour markets

- recovering global economy

- more buoyant commodity prices.

Mergers and acquisitions activity

A number of factors are impacting the small and mid-cap business transaction market in Australia and these are likely to continue to shape deal flows in 2018.

Key drivers of M&A activity:

- Growth through acquisition – given earnings and balance sheets have strengthened and repaired since the GFC, mid-cap firms are exploring opportunities to grow by inorganic means (i.e. via acquisition and joint ventures), particularly as markets become ultra-competitive;

- Market consolidations – companies are looking to achieve economies of scale by upscaling operations through strategic purchases, along with extending their product and services range to additional customer bases;

- Fuelling growth through innovation – companies are turning to M&A and corporate venturing to leverage the growth potential that new/disruptive technologies are enabling;

- Corporate growth and diversification – mid-market acquisitions are enabling corporate buyers to achieve inorganic growth (i.e. providing diversification and access to new markets without having to start from scratch).

These key drivers, coupled with the low interest rate environment and strong corporate balance sheets and profits, are seeing an increasing demand in M&A activity in small, medium and large market transactions – likely to be sustained throughout 2018.

Potential downside risks to the forecast:

- Political uncertainty – potential to impact business conditions and confidence

- Rising interest rates – increases in costs of capital may result in reduced investment appetite.

What does this activity mean for business values?

For businesses with a proven business model and solid track record of earnings (regularly 15%+ as a percentage of revenue), JPAbusiness has seen a tightening of multiples being paid and an uptick in interest from investors, larger corporates and competitors in certain industries.

For the mid-cap and upper SME market (i.e. firms broadly in the turnover range $5m–$50m), multiples of business maintainable earnings for these types of enterprises are typically ranging from 2.75x to 4.25x, although they vary from industry to industry and firm to firm, and also depend on the structure and terms of specific deals.

The relatively low cash rate – 1.5% p.a. – and somewhat benign market outlook on interest rates, are also adding impetus to the mid-cap transaction market in Australia, with investors and others looking for higher returns and to diversify previous, more defensive (GFC-impacted) portfolios.

Business finance story not so positive

Counter to this, however, the prevailing, somewhat negative, view amongst financial institutions in lending to SMEs, or to companies wishing to purchase SMEs, has resulted in a pretty ordinary business finance market, which may cap M&A activity amongst small to medium-sized transactions over 2018.

In some instances we are seeing transactions done with a greater component of vendor finance or earnout provisions, to account for the shortfall in lending appetite.

Overall we see a firming business M&A and transaction market in Australia in 2018.

Economic overview

Overall, the Australian economy is expected to grow and improve in 2018.

However, there is uncertainty around household consumption, as it faces downside and deflationary risks from slow wages growth and financial instability.

How does this affect your business?

Potential positive impacts:

- Low wages growth serves to reduce business costs across many industries, subject to availability of skilled labour

- Low interest rates provide accommodative financial conditions for borrowing capital for investment

- Government spending on infrastructure promotes activity in building and construction, and related industries

- Higher global commodities prices beneficial for commodity exporters across the board; further supported by a lower AUD.

Potential negative impacts:

- Weak private consumption growth anticipated to hit retailing industry the hardest – especially in regards to discretionary goods

- Lower AUD adversely affects importing businesses.

About the authors

This Australian Economic Outlook has been prepared by JPAbusiness business analysts Phillip James and Alex Dzang.

Phillip and Alex provide JPAbusiness and its clients with financial and business analysis, research and support services across a range of client requirements and in-house projects.

Phillip and Alex provide JPAbusiness and its clients with financial and business analysis, research and support services across a range of client requirements and in-house projects.

Prior to joining JPAbusiness, Phillip (pictured left) studied at the University of Canterbury, New Zealand, where he graduated with a Bachelor of Commerce, majoring in Economics and Finance.

Alex (pictured right) holds a Bachelor of Business and Commerce, with a major in Accounting, from Western Sydney University.

with a major in Accounting, from Western Sydney University.

Alex previously worked in accountancy firms in the Sydney CBD and brings an energetic and passionate approach to assisting clients with growth and exit strategies.

Sources

- ABS 2017, 5625.0 – Private New Capital Expenditure and Expected Expenditure, Australia, Jun 2017

http://www.abs.gov.au/AUSSTATS/abs@.nsf/Lookup/5625.0Main+Features1Jun%202017?OpenDocument - ABS 2017, 6202.0 – Labour Force, Australia, Sep 2017

http://www.abs.gov.au/ausstats/abs@.nsf/mf/6202.0 - ABC News 2017, Interest rates: ANZ joins NAB in predicting the RBA will raise twice next year

http://www.abc.net.au/news/2017-09-20/anz-joins-nab-in-predicting-the-next-rba-move-will-be-up/8964804 - ABC News 2017, IMF warns Australia on household debt vulnerability

http://www.abc.net.au/news/2017-10-04/imf-warns-australia-on-household-debt/9013634 - Bloomberg 2017, RBA Shows Investment Confidence, Doubts on Consumer as Rate Held

https://www.bloomberg.com/news/articles/2017-11-07/australia-holds-rates-as-weak-inflation-offsets-robust-hiring - Business Insider 2017, Bill Evans just outlined why the RBA should not hike interest rates next year

https://www.businessinsider.com.au/bill-evans-westpac-rba-interest-rates-2017-9 - Business Insider 2017, This analyst says the RBA looks set to hike interest rates, and far sooner than most people think

https://www.businessinsider.com.au/the-rba-looks-set-to-hike-interest-rates-and-far-sooner-than-what-most-people-think-2017-9 - Business Insider 2017, This strategist says the RBA is running out of reasons to keep interest rates at record-lows

https://www.businessinsider.com.au/rba-interest-rate-increase-may-2018-td-securities-2017-9 - Business Insider 2017, ANZ believes the Aussie dollar rally has further to run

https://www.businessinsider.com.au/australian-dollar-forecast-anz-september-2017-9 - CBA Website 2017, Australian dollar forecasts raised on Trump uncertainties

https://www.commbank.com.au/guidance/economy/australian-dollar-forecasts-raised-on-trump-uncertainties-201705.html - The Currency Shop, 2018 Australian Dollar Forecast

https://www.thecurrencyshop.com.au/exchange-rates/forecast/aud-australian-dollar - NAB Website 2017, Exchange rate forecasts

https://www.nab.com.au/business/international-and-foreign-exchange/financial-markets/exchange-rate-forecast - NAB Website 2017, NAB Quarterly Business Survey: September Quarter 2017

https://business.nab.com.au/nab-quarterly-business-survey-september-quarter-2017-26787/ - RBA Statement 2017, Statement on Monetary Policy – August 2017

https://www.rba.gov.au/publications/smp/2017/aug/economic-outlook.html - Sydney Morning Herald 2017, Clouds are clearing for slow wages growth, says Deloitte

http://www.smh.com.au/business/the-economy/clouds-are-clearing-for-slow-wages-growth-says-deloitte-20171020-gz4xox.html - Westpac 2017, Australia & New Zealand weekly: Week beginning 6 November 2017

https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/aw/economics-research/WestpacWeekly.pdf - Pitcher Partners, Dealmakers: Mid-Market M&A in Australia 2017

http://www.pitcher.com.au/sites/default/files/downloads/Pitcher%20Partners_Mid%20market%20Report%202017_FINAL.PDF - The Deloitte M&A Index 2017

https://www2.deloitte.com/au/en/pages/finance/articles/au-deloitte-ma-index.html